The GBP/USD currency pair continued its upward movement on Thursday, as expected. At this point, discussing the fundamentals or macroeconomics doesn't hold much weight.

First, the GBP/USD pair remains within a sideways channel on the daily timeframe. This means price can move hundreds of points in either direction without any specific catalyst, which is precisely what we've seen in recent weeks.

Second, there's nothing new or positive happening globally for the U.S. dollar. Trump continues to issue threats, start conflicts, impose tariffs and sanctions, and try to force his views on the entire world.

Third, the longer-term upward trend remains in place, and there are no credible reasons for dollar strength at this time. As a result, while the pair may stay in a range for one, two, or even three more months, it still appears the bullish trend will resume—regardless of the surrounding circumstances.

This week, the British currency started to rise despite mixed economic data out of the U.K. On one hand, the unemployment rate increased; on the other, GDP and industrial production data came in better than expected. Interestingly, the higher unemployment figure didn't prevent sterling from strengthening, and the market largely ignored the positive GDP and industrial figures. Once again, it's clear that traders pay little attention to British data.

Instead, they care about U.S. fundamentals. Listing every reason why the dollar should fall could fill an entire article. Today—the final trading day of the week—there are no major reports or events scheduled in either the U.K. or the U.S.

Of course, Donald Trump or his close ally Scott Bessent could deliver new explosive statements targeting China, India, or the Federal Reserve. But the thing is, an "explosive" event loses its impact when it happens every day. Imagine the market being told that Trump wants to raise tariffs on China not by 500%, but 1,500%. What would change? Nothing positive for the dollar—just more decline along the same uninterrupted path.

To highlight another issue, Trump demonstrates a lack of political diplomacy in his standoff with the Democrats. The budget standoff is arguably the first time in 2025 that Democrats have managed to block one of his initiatives. Usually, Trump made decisions unilaterally without congressional oversight. It's striking that lawsuits are being filed against Trump for violating U.S. laws and overstepping his authority, yet no single controversial decision has been overturned. In just a year, the U.S. has transformed from a democratic nation governed by law into a "one-man state." Today, Trump loses a round of golf; tomorrow, he imposes 500% tariffs. Today, Trump doesn't win a Nobel Prize; tomorrow, India is blamed for buying oil at a good price. It's a circus.

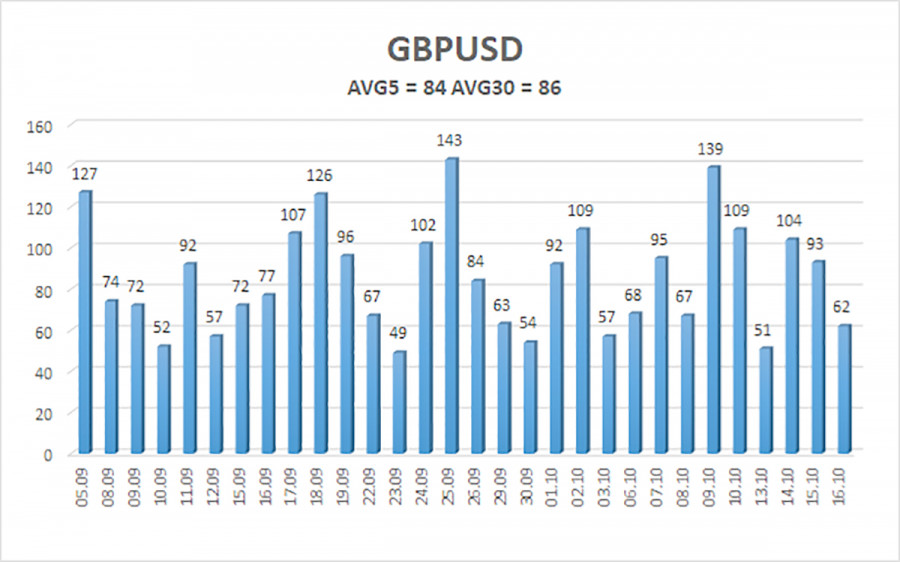

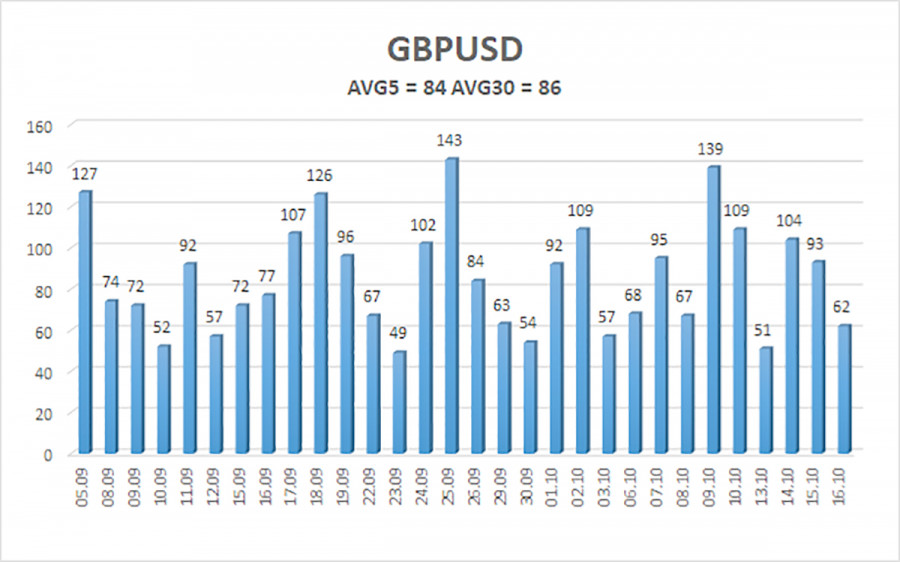

The average volatility of the GBP/USD pair over the last five trading days is 84 pips, which is considered "average" for the pound/dollar. For Friday, October 17, we expect movement within the range of 1.3344 to 1.3512. The long-term linear regression channel is pointed upward, confirming the prevailing upward trend. The CCI indicator has entered the oversold zone three times recently, which may signal a resumption of upward momentum.

Nearest support levels:

S1 – 1.3428

S2 – 1.3367

S3 – 1.3306

Nearest resistance levels:

R1 – 1.3489

R2 – 1.3550

R3 – 1.3611

Trading Recommendations:

The GBP/USD pair is currently in a corrective move, but its long-term outlook remains unchanged. Donald Trump's policies will continue to apply pressure to the dollar, so we do not expect any meaningful gains from the U.S. currency. Thus, long positions with targets at 1.3672 and 1.3733 remain more relevant as long as the price remains above the moving average. If the pair drops below the moving average line, small short positions become possible with targets at 1.3306 and 1.3245, based purely on technical analysis. From time to time, the dollar stages short-term corrections (as it's doing now), but a sustained bullish movement will require real signs that the trade war is ending—or other major positive catalysts.

Explanation of Illustrations:

- Linear regression channels help identify the current trend. If both channels point in the same direction, the trend is strong.

- The moving average line (settings: 20.0, smoothed) defines the short-term trend and a suitable trade direction.

- Murray levels are calculated target zones for price movement and corrections.

- Volatility levels (red lines) indicate the expected price range for the next 24 hours based on current volatility metrics.

- The CCI indicator: entering the oversold area (below -250) or overbought area (above +250) suggests a trend reversal may be imminent.