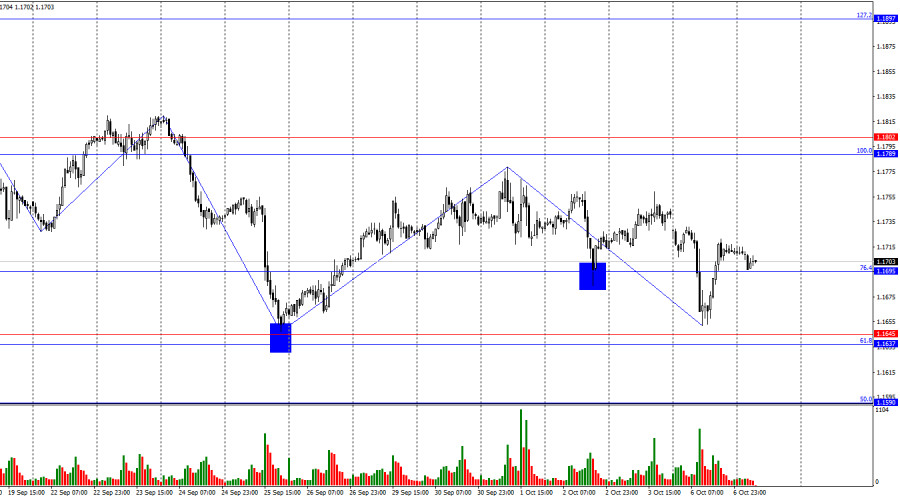

On Monday, the EUR/USD pair resumed its decline against forecasts but during the day still reversed in favor of the euro and consolidated above the 76.4% Fibonacci level at 1.1695. Thus, today the growth process may continue toward the resistance zone of 1.1789–1.1802. A new close below 1.1695 would work in favor of the U.S. dollar and a fresh decline toward the support zone of 1.1637–1.1645.

The wave situation on the hourly chart remains simple and clear. The last completed upward wave broke the previous wave's peak, while the new downward wave has not yet broken the previous low. Therefore, the trend remains "bearish" for now. Recent labor market data and shifting expectations for Fed monetary policy are supporting bullish traders, which is why I expect a trend change to "bullish." For the "bearish" trend to end, price consolidation above the last peak at 1.1779 is required.

On Monday, there were few noteworthy events for the market, but bears attacked in the first half of the day not without reason. I remind you that the general news background supports bulls rather than bears, so the new euro decline was unexpected. However, the political crisis in France, which led to the resignation of the fifth prime minister in the last two years, had its impact. I do not think the euro's fall will continue, since the ECB is expected to stick with its current rate policy, while the Fed is highly likely to introduce another monetary easing step at the end of this month. At the same time, the U.S. continues to struggle with the government shutdown, and the labor market remains weak. Bullish traders are still waiting for the right moment to go on the offensive, but for now the trend remains "bearish," which should be kept in mind. The news background on Tuesday will be light, with only Christine Lagarde's speech on the calendar. However, on Monday, the ECB President also spoke without making important statements.

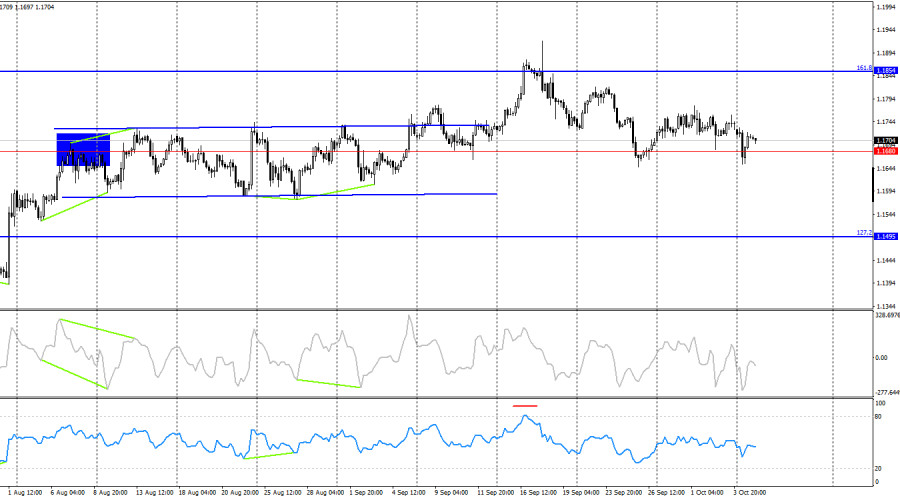

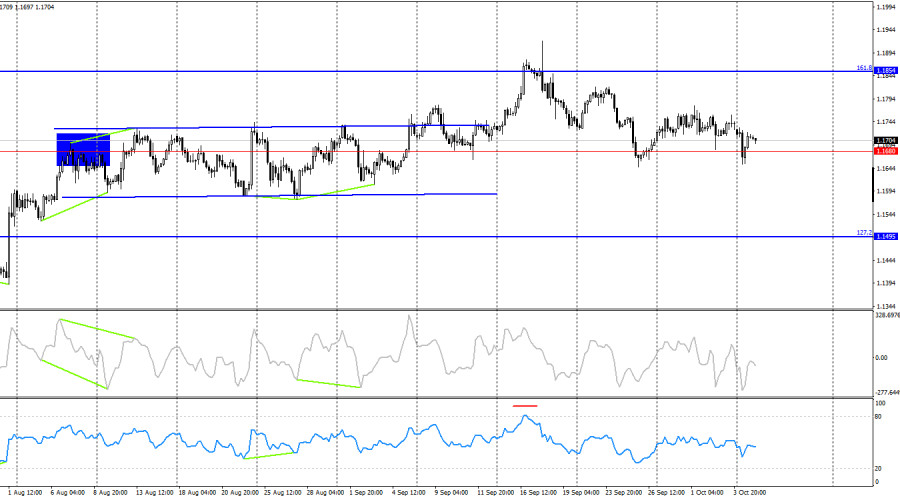

On the 4-hour chart, the pair reversed in favor of the euro around the 1.1680 level, but in recent months movements have been almost horizontal. Growth may resume toward the 161.8% retracement level at 1.1854. A consolidation of the pair's rate below 1.1680 would favor the U.S. dollar and open the way for a further decline toward the 127.2% Fibonacci level at 1.1495. No emerging divergences are observed today.

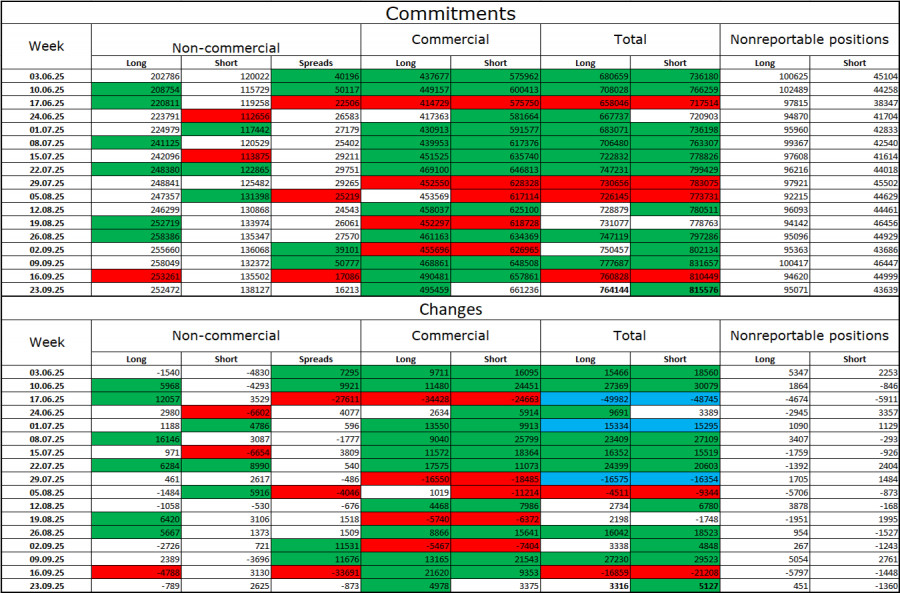

Commitments of Traders (COT) Report:

During the last reporting week, professional players closed 789 long positions and opened 2,625 short positions. The sentiment of the "Non-commercial" group remains "bullish" thanks to Donald Trump and is strengthening over time. The total number of long positions held by speculators now stands at 252,000, while short positions total 138,000 – a nearly twofold gap. In addition, note the number of green cells in the table above, which reflect a strong buildup of positions in the euro. In most cases, interest in the euro continues to grow, while interest in the dollar falls.

For thirty-three consecutive weeks, large players have been shedding short positions and adding longs. Donald Trump's policies remain the most significant factor for traders, as they could cause many problems of a long-term and structural nature for the U.S. Despite the signing of several key trade agreements, many major economic indicators are showing decline.

News Calendar for the U.S. and the EU:

- EU – Speech by ECB President Christine Lagarde (16:10 UTC).

On October 7, the economic events calendar contains only one entry, which is important but only relatively so. The impact of the news background on market sentiment on Tuesday may be present.

Forecast for EUR/USD and advice to traders:

Sales will be possible on a rebound from the 1.1789–1.1802 zone with a target of 1.1695, or on a close below 1.1695. Purchases were possible on a close above 1.1695 on the hourly chart with a target of 1.1789–1.1802.

The Fibonacci grids are built from 1.1789–1.1392 on the hourly chart and from 1.1214–1.0179 on the 4-hour chart.