Trade analysis and advice for trading the British pound

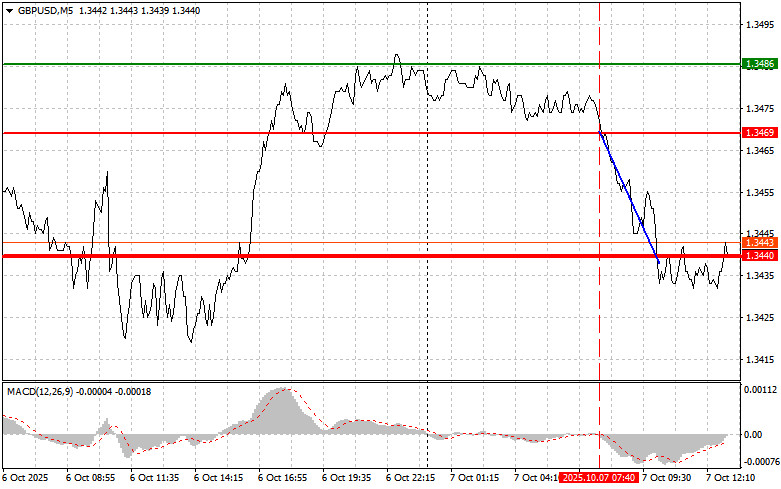

The test of 1.3469 coincided with the MACD indicator just beginning to move down from the zero line, which confirmed the correct entry point for selling the pound. As a result, the pair dropped toward the target level of 1.3440.

A sharp decline in the Halifax House Price Index in the UK brought renewed pressure on the GBP/USD pair. The published data, showing an unexpected drop in housing prices, intensified concerns about the state of the British economy and the prospects for further monetary tightening by the Bank of England.

Investors closely monitoring financial stability indicators viewed this report as a warning sign—especially since growth was forecast, not a decline.

After the morning volatility caused by a series of data releases, market attention in the second half of the day will shift to U.S. macroeconomic statistics. Of particular interest are the trade balance and consumer credit figures. A larger-than-expected trade deficit could put pressure on the dollar, as it signals a greater reliance on imports, which is generally negative for the currency. However, Trump's policies could significantly influence this metric. Meanwhile, consumer credit is an important indicator of household sentiment and spending willingness. Growth in consumer credit typically signals optimism and confidence in the future, which usually supports economic growth.

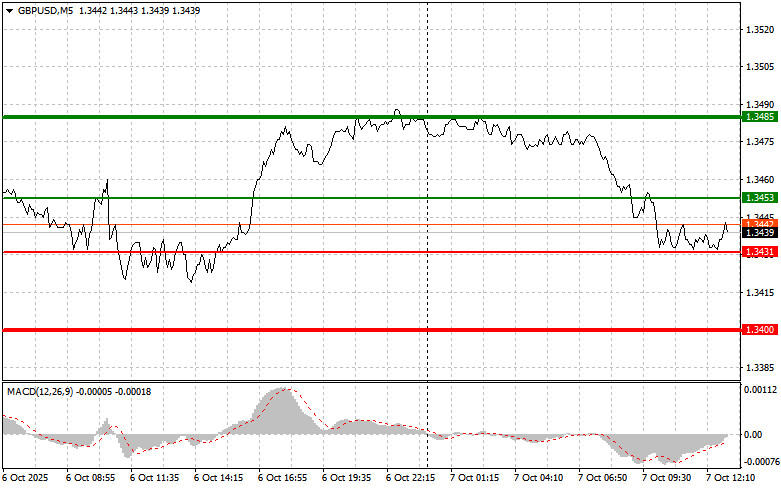

As for intraday strategy, I will rely more on scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the pound today at an entry point around 1.3453 (green line on the chart) with a target at 1.3485 (thicker green line on the chart). Around 1.3485, I will exit the long positions and open sales in the opposite direction (expecting a 30–35 point reversal). A strong rally in the pound today can be expected only after weak U.S. statistics. Important! Before buying, make sure the MACD indicator is above zero and just beginning to rise from it.

Scenario #2: I also plan to buy the pound if there are two consecutive tests of 1.3431 while the MACD indicator is in the oversold area. This would limit the pair's downward potential and lead to an upward reversal. Growth toward the opposite levels of 1.3453 and 1.3485 may then be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after breaking below 1.3431 (red line on the chart), which will trigger a quick decline in the pair. The sellers' key target will be 1.3400, where I will exit short positions and immediately open long positions in the opposite direction (expecting a 20–25 point rebound). The pound could drop sharply in the second half of the day. Important! Before selling, make sure the MACD indicator is below zero and just beginning to decline from it.

Scenario #2: I also plan to sell the pound if there are two consecutive tests of 1.3453 while the MACD indicator is in the overbought area. This would limit the pair's upward potential and lead to a downward reversal. A decline toward the opposite levels of 1.3431 and 1.3400 may then be expected.

Chart Legend

- Thin green line – entry price to buy the trading instrument.

- Thick green line – suggested level to set Take Profit or manually fix profit, as further growth above this level is unlikely.

- Thin red line – entry price to sell the trading instrument.

- Thick red line – suggested level to set Take Profit or manually fix profit, as further decline below this level is unlikely.

- MACD indicator – when entering the market, pay attention to overbought and oversold zones.

Important: Beginner Forex traders must take great care when deciding on market entry. Before major fundamental reports are released, it is best to stay out of the market to avoid sharp volatility. If you choose to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember: successful trading requires a clear trading plan—like the one I presented above. Spontaneous decisions based only on the current market situation are, from the outset, a losing strategy for intraday traders.