Trade analysis and advice for trading the euro

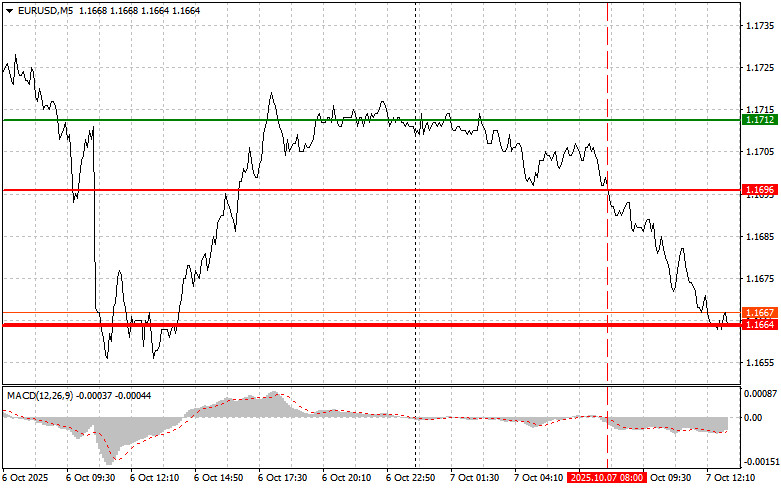

The price test of 1.1696 coincided with the MACD indicator just beginning to move down from the zero line. This confirmed the correct entry point for selling the euro and resulted in a 30-point drop in the pair.

The political crisis in France continues: today, French Defense Minister Le Maire also resigned. This came just a day after the resignation of the Prime Minister, who had served for only 27 days. Political turbulence has reached its peak, plunging the country into deep uncertainty and calling into question the stability of the ruling coalition.

The resignation of key government figures one after another indicates a serious split within the ruling elite and the inability to find compromise on key issues of domestic and foreign policy. Clearly, the wave of resignations is rooted in fundamental disagreements over economic reforms, next year's budget, and France's role in the European Union. All this, undeniably, puts pressure on the euro.

As for the outlook for the second half of the day, the key focus will be on U.S. trade balance and consumer credit data. Positive figures, especially a reduction in the trade deficit due to Trump's policies, could support the dollar. Additionally, speeches are scheduled from FOMC members Raphael Bostic and Michelle Bowman. If their tone leans dovish, it could quickly bring renewed pressure on the dollar.

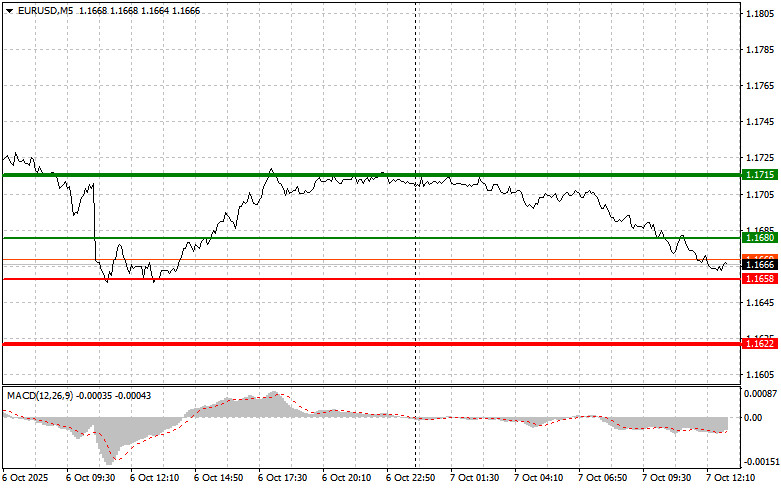

As for the intraday strategy, I will rely more on scenarios #1 and #2.

Buy Signal

Scenario #1: Today, buying the euro is possible at around 1.1680 (green line on the chart) with a target of rising to 1.1715. At 1.1715, I plan to exit the market and also sell the euro in the opposite direction, expecting a 30–35 point move from the entry level. A euro rally today can be expected only after weak U.S. data. Important! Before buying, make sure the MACD indicator is above zero and just beginning to rise from it.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.1658 level at the moment when the MACD indicator is in the oversold zone. This would limit the pair's downward potential and lead to a reversal upward. Growth toward the opposite levels of 1.1680 and 1.1715 may then be expected.

Sell Signal

Scenario #1: I plan to sell the euro after reaching 1.1658 (red line on the chart). The target will be 1.1622, where I will exit the market and immediately buy in the opposite direction (expecting a 20–25 point rebound from this level). Pressure on the pair may return at any moment today. Important! Before selling, make sure the MACD indicator is below zero and just beginning to decline from it.

Scenario #2: I also plan to sell the euro if there are two consecutive tests of the 1.1680 level while the MACD indicator is in the overbought zone. This would limit the pair's upward potential and lead to a reversal downward. A decline toward the opposite levels of 1.1658 and 1.1622 may then be expected.

Chart Legend

- Thin green line – entry price for buying the trading instrument.

- Thick green line – expected level to set Take Profit or manually fix profits, since further growth above this level is unlikely.

- Thin red line – entry price for selling the trading instrument.

- Thick red line – expected level to set Take Profit or manually fix profits, since further decline below this level is unlikely.

- MACD indicator – when entering the market, focus on overbought and oversold zones.

Important: Beginner Forex traders must make entry decisions with great caution. Before the release of major fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you choose to trade during news events, always place stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember: to trade successfully, you must have a clear trading plan—like the one I have presented above. Spontaneous decision-making based solely on the current market situation is a losing strategy for intraday traders from the start.