Investor sentiment is recovering, while the US dollar is declining after the end of the protracted government shutdown.

At the beginning of the American trading session on Thursday, futures on the US dollar index (USDX) were trading near 99.25, slightly above the intraday low of 99.12, reached in the first half of the European trading session.

Let's take a closer look at the current situation in the market and investor expectations regarding this event, highlighting the key points:

- Trump's signing of the funding bill allows for hopes of temporary stabilization of the US currency rate.

- Market participants are anticipating the Federal Reserve's decisions regarding possible interest rate cuts in December.

The conclusion of the longest government shutdown in US history was made possible by passing a document that received majority support in the House of Representatives. Nearly all Republican representatives and some Democrats supported the bill. After its approval, Trump officially enacted it, paving the way for the resumption of normal government operations.

However, the end of the budget crisis has not become a decisive event for currency markets. Many economic indicators critical for assessing the state of the economy are delayed and may not be available in the near future. Among the expected indicators are the employment statistics and the consumer price index (CPI). The White House has warned that the October data may not be released at all.

Despite this, economists are confident that further disclosure of previously postponed statistical data will show a slowdown in US economic growth, strengthening the case for a rate cut by the Federal Reserve. Economists, in particular, have calculated that the prolonged government shutdown has already led to a decline in quarterly GDP growth of approximately 1.5% to 2.0%. This situation complicates matters significantly for supporters of a stronger dollar.

Furthermore, some data from private statistical organizations published last week has had a negative impact. According to their reports, the number of employed decreased by 9,100 in October, while the payroll fund for government employees also fell by 22,200. The analysis from the Chicago Fed confirms a deterioration in the labor market, noting a slight increase in the unemployment rate over the past month.

The Fed remains internally contradictory regarding changes to monetary policy. For instance, Stephen Miran recently expressed the view that the US central bank's policy has become overly tight due to weak inflation processes in the housing sector. His colleague, Atlanta Fed President Raphael Bostic, on the other hand, advocated for maintaining the current rate levels until clear evidence of inflation returning to the target of 2% appears.

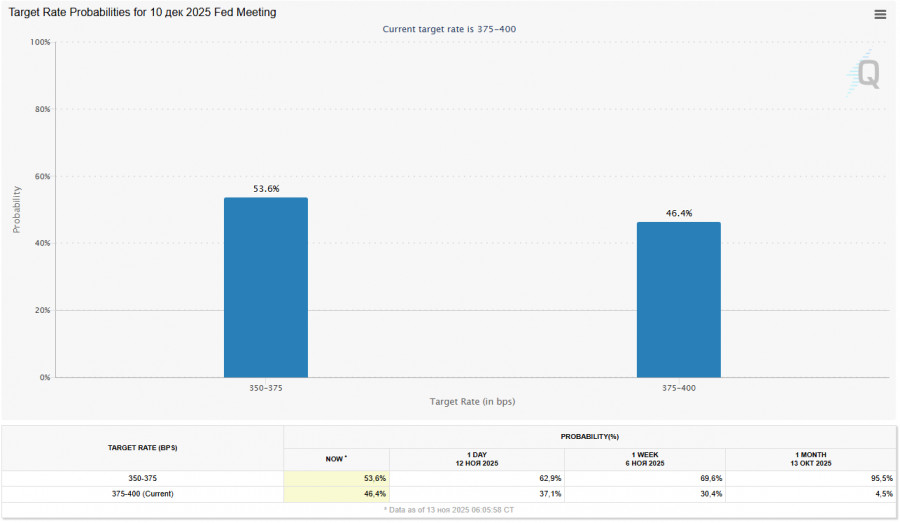

Currently, markets are assessing the probability of a Fed rate cut in December at about 54%, down from 63% a day earlier and 69% last week.

Technical Picture

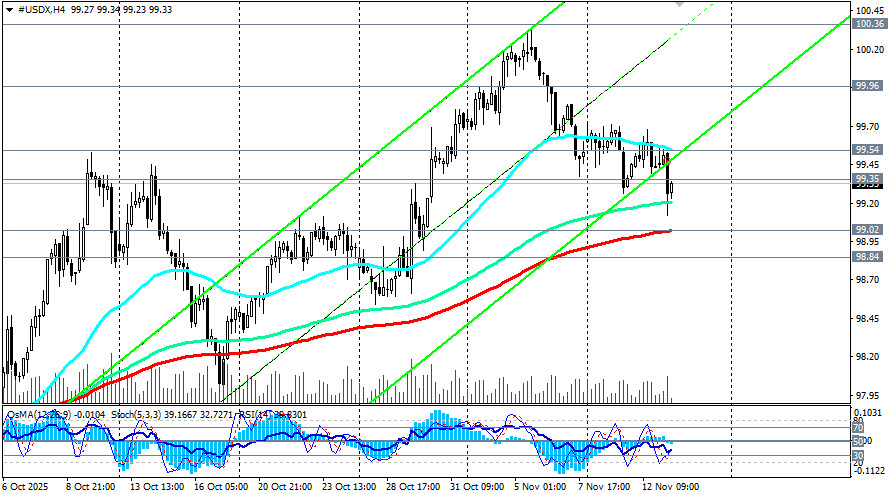

Having failed to overcome the important short-term resistance level at 99.54 (the 200-period moving average on the 1-hour chart), the price of USDX futures continued to decline, moving into the mid- and long-term bearish market zones.

According to the daily chart, the price has found support at the critical level of 99.35 (144-period moving average on the daily chart). The nearest targets in the event of a breakout will be the support levels of 99.02 (200-period moving average on the 4-hour chart) and 98.84 (50-period moving average and the lower line of the upward channel on the daily chart), from which new long positions might be considered, given the likelihood of a resumption of the mid-term bullish trend and a transition into a mid-term bullish market situated above the key resistance level of 99.96 (200-period moving average on the daily chart).

A break below the support zone of 99.02–98.84 and further declines would worsen the price outlook, particularly given that technical indicators (in this case, RSI, OsMA, Stochastic) on the daily chart have turned towards short positions.

What's on?

During the American trading session, several high-ranking Fed officials were scheduled to speak, and their comments, in light of the absence of significant previously scheduled reports (on job claims and the CPI index), may further influence market sentiment. Statements from politicians will also serve as important benchmarks for shaping expectations regarding the further movements of the US currency.

Final Conclusions

Although the resumption of activity by American authorities has allowed optimism to return among investors, the overall impact on the dollar remains limited due to uncertainty about the published macro data. The further development of events surrounding the dollar depends on future speeches from Fed leadership and the publication of new economic data, which will reveal the real consequences of the "shutdown."