Trade Review and Tips for Trading the British Pound

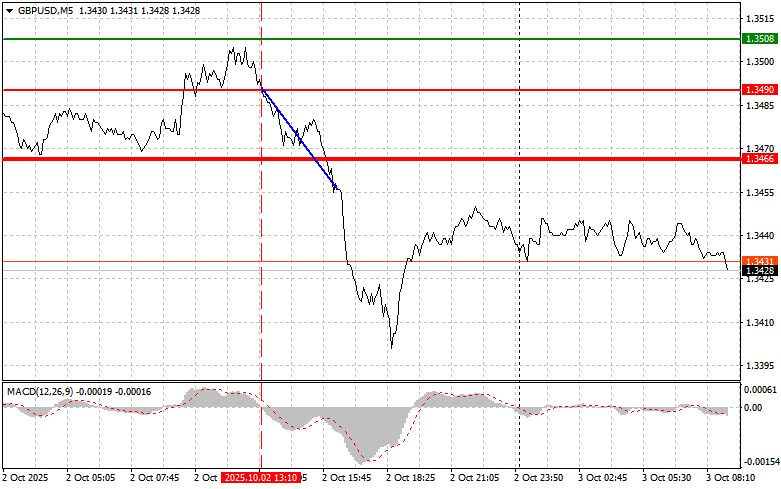

The test of the 1.3490 price level occurred just as the MACD indicator began moving downward from the zero line, confirming a valid entry point for selling the pound, which resulted in a drop of over 40 pips.

Strong U.S. data, supported by hawkish rhetoric from the Federal Reserve, restored confidence in a more cautious approach by the Fed regarding interest rate cuts. This, in turn, makes the U.S. dollar more attractive to yield-seeking investors. The pound, however, came under pressure. The situation is further complicated by the fact that the Bank of England is facing a greater challenge than the Fed. The UK central bank must contain inflation without collapsing an already fragile economy, teetering on the edge of recession.

Later this morning, we'll see the release of the UK's Services PMI and the Composite PMI. Additionally, a public speech is scheduled by Bank of England Governor Andrew Bailey. These events will undoubtedly have a significant impact on the pricing trajectory of the British currency and, more broadly, on the assessment of economic risks tied to the United Kingdom.

Historically, the services PMI is a key indicator of economic well-being due to the dominant role of the service sector in the UK's GDP structure. A reading above 50 signals growth, while a reading below 50 indicates a contraction in activity. The Composite PMI combines data from both the services and manufacturing sectors, offering a more holistic view of the economic climate. Weak PMI figures could signal a slowdown in economic momentum, thereby increasing pressure on the Bank of England to take more aggressive monetary policy action.

Nevertheless, the central highlight will be Andrew Bailey's speech. Market participants will closely examine his remarks for any hints about the BoE's future interest rate strategy.

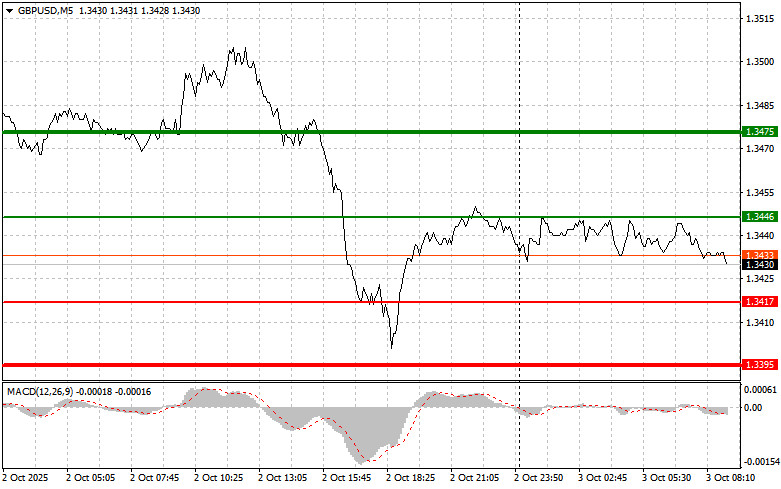

As for the intraday strategy, I will focus mainly on Scenarios #1 and #2.

Buy Scenarios

Scenario #1: I plan to buy the pound today upon reaching the entry point around 1.3446 (the green line on the chart), with a target of moving toward 1.3475 (the thicker green line on the chart). At 1.3475, I plan to exit long positions and open sell trades in the opposite direction, expecting a pullback of 30–35 pips from that level. Bullish pound positions are only justified if strong economic data is released. Important: Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: I also plan to buy the pound if the price tests the 1.3417 level twice while the MACD indicator is in the oversold zone. This would limit the downside potential of the pair and lead to a market reversal to the upside. A rise to the opposite levels of 1.3446 and 1.3475 can be expected.

Sell Scenarios

Scenario #1: I plan to sell the pound today after a breakout below 1.3417 (red line on the chart), which could trigger a sharp decline in the pair. The key target level for sellers will be 1.3395, where I plan to exit the short position and immediately open a buy position on the rebound—expecting a recovery of 20–25 pips from that level. Pound sellers may look to strengthen their advantage at any opportunity. Important: Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline.

Scenario #2: I also plan to sell the pound today in the event of two consecutive tests of the 1.3446 level, with the MACD indicator in the overbought zone. This will limit the pair's upward potential and lead to a reversal to the downside. A drop toward the opposite levels of 1.3417 and 1.3395 is expected.

Chart:

- Thin green line – the entry price level where the instrument may be bought

- Thick green line – an approximate price level where Take Profit orders may be placed, or where profits should be manually fixed, as further growth is unlikely above that level

- Thin red line – the entry price level where the instrument may be sold

- Thick red line – an approximate price level for placing Take Profit orders, or manually securing profits, as further price declines below that level are unlikely

- MACD indicator – it's important to use overbought and oversold zones when entering the market

Important Note for Beginner Forex Traders:

Beginner traders should exercise extreme caution when deciding to enter the market. It is best to avoid trading during important economic data releases to prevent being caught in sharp price movements.

If you choose to trade during news events, always use stop-loss orders to minimize potential losses. Without stop-losses, you can quickly lose your entire deposit—especially if you ignore money management and trade with large volume sizes.

And remember: to succeed in trading, you need to have a clear trading plan—just like the one I've outlined above. Making spontaneous trading decisions based on the current market situation is a losing strategy for intraday traders.