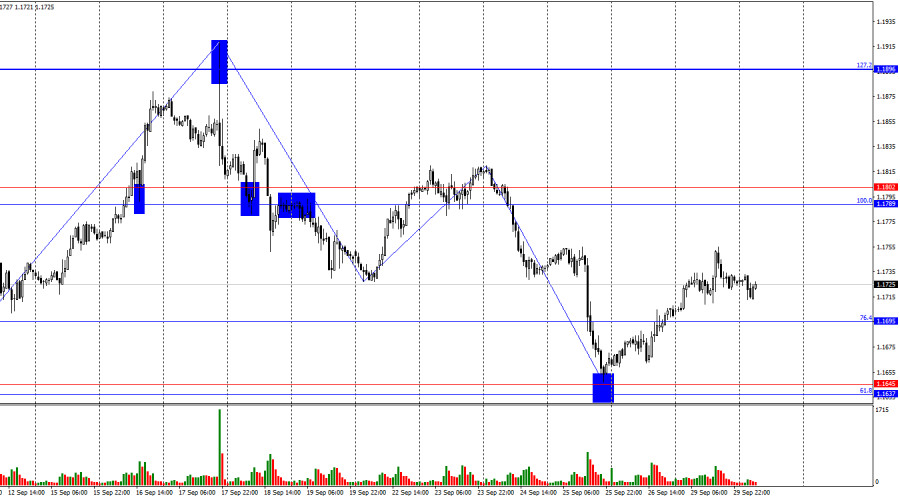

On Monday, the EUR/USD pair continued its upward movement after rebounding from the support zone of 1.1637–1.1645. Thus, the rise of the European currency may continue today toward the resistance zone of 1.1789–1.1802. A close of the pair below the 1.1695 level would favor the U.S. currency and a return to the 1.1637–1.1645 level.

The wave picture on the hourly chart remains simple and clear. The last completed downward wave broke the low of the previous wave, while the new upward wave did not break the previous low. Therefore, the trend remains bearish for now. Recent labor market data and shifting prospects for Federal Reserve monetary policy support bullish traders, which means the trend may start to change again this week. For the bearish trend to end, the price needs to consolidate above the last peak at 1.1819.

On Monday, the news background for the euro and the dollar was relatively weak. However, the looming threat of a U.S. government shutdown still influences bearish sentiment. A shutdown means a temporary suspension of the work of all government structures, including federal agencies. It does not imply a government collapse but rather the suspension of certain agencies due to lack of funding when Congress fails to agree on spending for the new fiscal year. That is precisely what is happening now in America. A shutdown itself is not a threat to economic stability, but it is still a negative development. Traders dislike such news because confidence in the government decreases when it cannot even approve the federal budget. Under Donald Trump, reaching agreements has been particularly difficult and often unsuccessful. Many experts expect this shutdown to last for a long time, with little chance of Republicans and Democrats reaching an agreement soon.

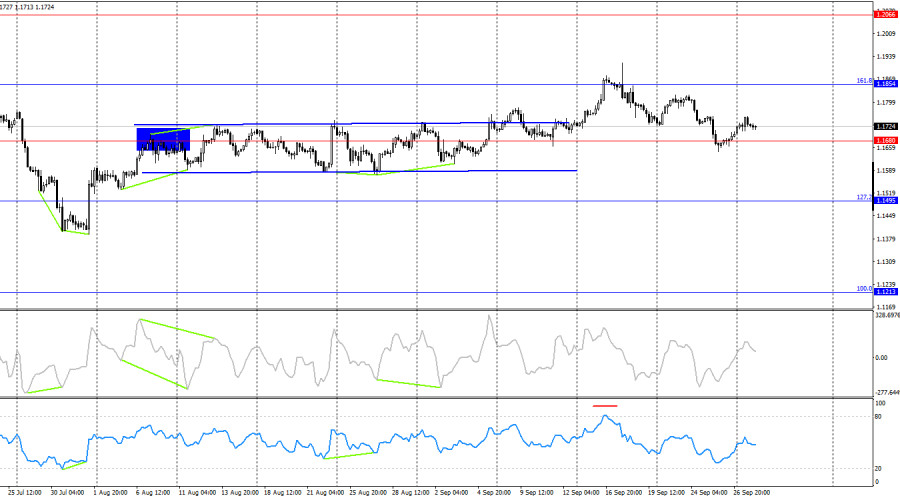

On the 4-hour chart, the pair reversed in favor of the euro near the 1.1680 level. Thus, the upward movement may resume toward the 161.8% corrective level at 1.1854. A close of the pair below 1.1680 would favor the U.S. dollar and allow for further decline toward the 127.2% Fibonacci level at 1.1495. No emerging divergences are currently observed.

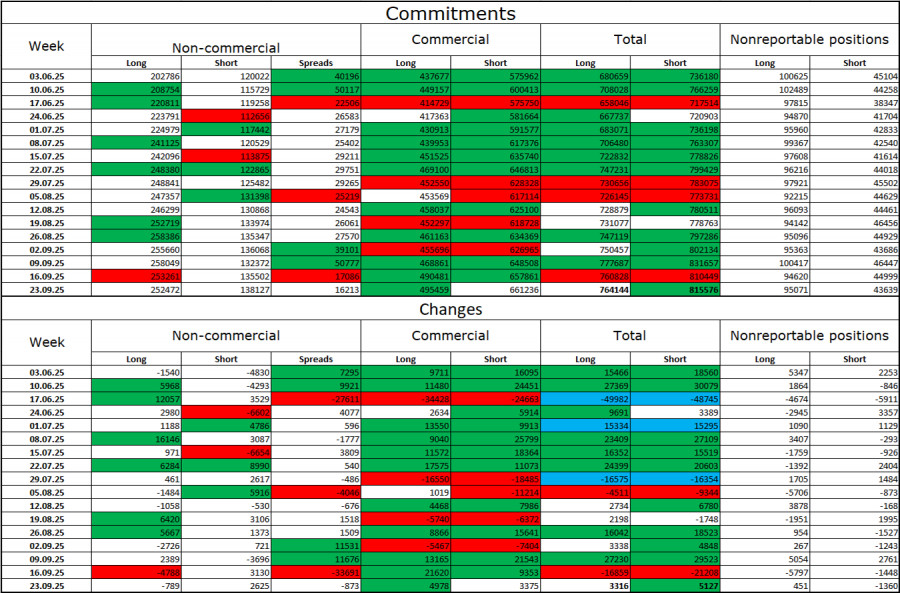

Commitments of Traders (COT) Report:

During the last reporting week, professional players closed 789 long positions and opened 2,625 short positions. The sentiment of the "Non-commercial" group remains bullish thanks to Donald Trump and is strengthening over time. The total number of long positions held by speculators now amounts to 252,000, while short positions are at 138,000—almost a twofold difference. Also, note the large number of green cells in the table above, showing strong increases in euro positions. In most cases, interest in the euro continues to grow while interest in the dollar declines.

For thirty-three consecutive weeks, large players have been reducing short positions and increasing long positions. Donald Trump's policies remain the most significant factor for traders, as they may cause many long-term structural problems for the U.S. economy. Despite the signing of several important trade agreements, many key economic indicators continue to show declines.

News calendar for the U.S. and the Eurozone:

Eurozone – Change in retail trade volumes in Germany (06:00 UTC). Eurozone – Unemployment rate in Germany (07:55 UTC). Eurozone – Change in the number of unemployed in Germany (07:55 UTC). Eurozone – Consumer Price Index in Germany (12:00 UTC). Eurozone – Speech by ECB President Christine Lagarde (12:55 UTC). U.S. – Change in JOLTS job openings (14:00 UTC).

On September 30, the economic calendar contains six events, at least half of which can be considered important. Market sentiment on Tuesday will be influenced by the news background.

EUR/USD forecast and trading advice:

Sales of the pair were possible on a close below the support level of 1.1789–1.1802 on the hourly chart with targets at 1.1695 and 1.1637–1.1645. All targets have been reached. New sales will be possible on a close below 1.1695 with a target at 1.1637–1.1645. Purchases were possible after a rebound from the 1.1637–1.1645 level with targets at 1.1695 and 1.1789–1.1802. These trades can remain open today with stop-losses moved to breakeven.

Fibonacci grids are built between 1.1789–1.1392 on the hourly chart and 1.1214–1.0179 on the 4-hour chart.