Trade Analysis and Recommendations for the British Pound

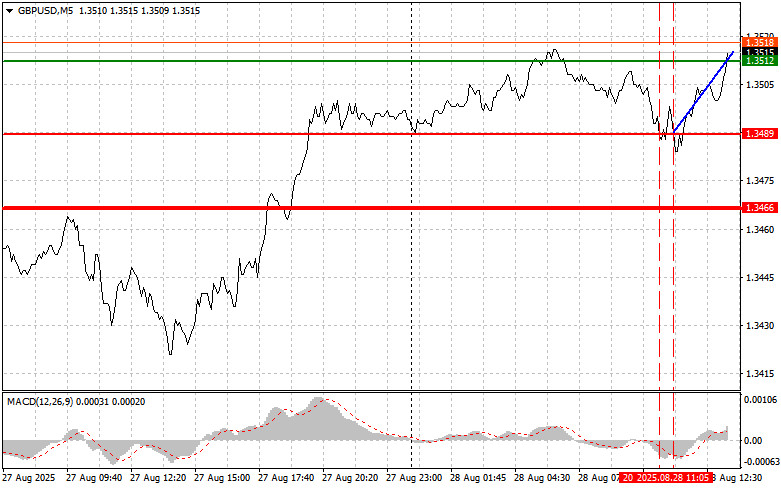

The price test at 1.3489 occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downward potential. For this reason, I did not sell the pound. The second test at 1.3489 happened when the MACD was in the oversold area, which allowed scenario No. 2 for buying to work out. As a result, the pair rose by more than 17 points.

The absence of U.K. economic data, as expected, supported pound buyers. However, further demand for the pound will remain stable only if upcoming economic data does not come in worse than economists' forecasts. The balance between demand, supply, and geopolitical risks will shape the currency's short-term prospects.

In the second half of the day, GBP/USD direction will depend on U.S. Q2 GDP figures and initial jobless claims. These two key economic indicators can significantly influence currency market trends, shaping both short- and long-term investment strategies. GDP data may trigger market fluctuations, especially if results come as a surprise. An increase in GDP is often seen as a sign of a healthy economy, which could strengthen the U.S. dollar. Conversely, weaker-than-expected results, or worse, negative figures, could trigger a dollar sell-off, driving the pound higher. The second important factor will be initial jobless claims. A decline in claims usually signals labor market stabilization, supporting the dollar. An increase, however, could point to economic problems, adding pressure on the dollar and opening the door for pound gains.

As for intraday strategy, I will focus primarily on implementing scenarios No. 1 and No. 2.

Buy Signal

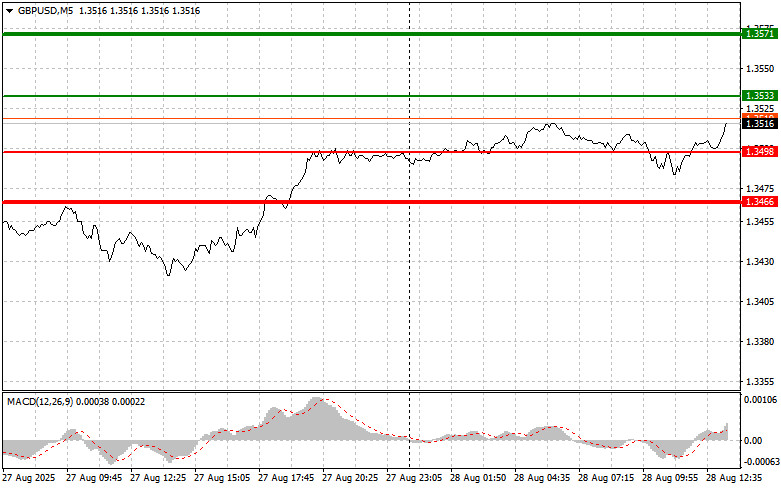

Scenario No. 1: Today, I plan to buy the pound at an entry point near 1.3533 (green line on the chart) with a target at 1.3571 (thicker green line). Around 1.3571, I plan to exit long positions and open short positions in the opposite direction (aiming for a 30–35 point reversal from the level). Strong pound growth can be expected after weak U.S. data.Important: Before buying, make sure the MACD indicator is above the zero line and just beginning its upward move.

Scenario No. 2: I also plan to buy the pound if there are two consecutive tests of 1.3498 when the MACD is in the oversold area. This would limit the pair's downward potential and lead to an upward reversal. Growth could be expected toward 1.3533 and 1.3571.

Sell Signal

Scenario No. 1: Today, I plan to sell the pound after a move below 1.3498 (red line on the chart), which would lead to a quick decline. The main target for sellers will be 1.3466, where I plan to exit short positions and open long positions in the opposite direction (aiming for a 20–25 point reversal from the level). Sellers may push the pound lower if U.S. GDP data is strong.Important: Before selling, make sure the MACD indicator is below the zero line and just beginning its downward move.

Scenario No. 2: I also plan to sell the pound in case of two consecutive tests of 1.3533 when the MACD is in the overbought area. This would limit the pair's upward potential and lead to a downward reversal. A decline could be expected toward 1.3498 and 1.3466.

Chart Notes:

- Thin green line – entry price for buying;

- Thick green line – projected Take Profit or manual profit-taking level, as further growth above this level is unlikely;

- Thin red line – entry price for selling;

- Thick red line – projected Take Profit or manual profit-taking level, as further decline below this level is unlikely;

- MACD indicator – use overbought and oversold zones when entering the market.

Important: Beginner traders in the Forex market must be very cautious when making entry decisions. Before major fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can very quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

And remember: successful trading requires a clear trading plan, such as the one presented above. Spontaneous trading decisions based on current market conditions are an inherently losing strategy for intraday traders.