Analysis of Trades and Trading Tips for the British Pound

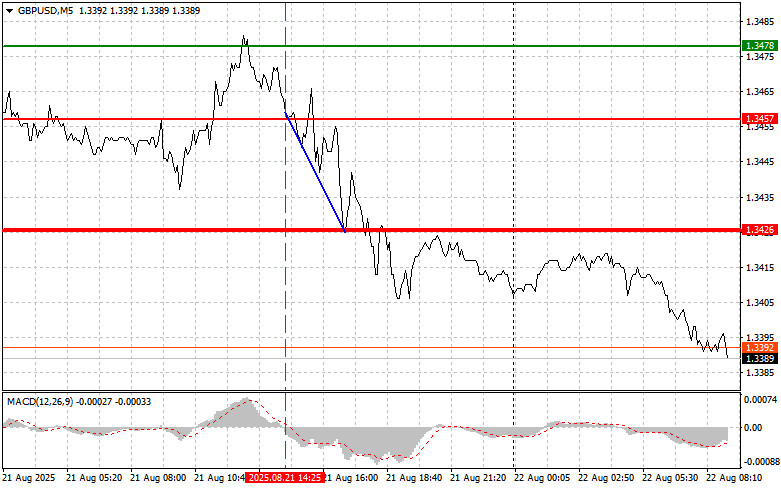

The test of the 1.3457 price level coincided with the MACD indicator just starting to move down from the zero line, which confirmed the correct entry point for selling the pound. As a result, the pair fell by more than 35 points.

Strong US PMI data, which turned out to be much better than economists' forecasts, supported the dollar yesterday and led to a sell-off in GBP/USD. The sharp jump in PMI, especially in the manufacturing sector, which moved back above the critical 50-point mark, signals the possible end of stagnation and the beginning of a phase of sustainable growth. This, in turn, reduces fears of recession and boosts investor confidence in the outlook for the US economy. The dollar's strengthening, driven by the upbeat PMI data, put pressure on GBP/USD. Investors, seeking safer assets and higher yields, began to sell off the British pound, which led to a decline in the pair.

Today, there are no data releases from the UK in the first half of the day. The absence of economic news leaves the pound vulnerable to external factors and market sentiment. Without domestic catalysts, which have determined the currency's direction recently, traders will closely monitor other global events, including the speech by Fed Chair Jerome Powell, which we will cover in more detail in the second-half forecast.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

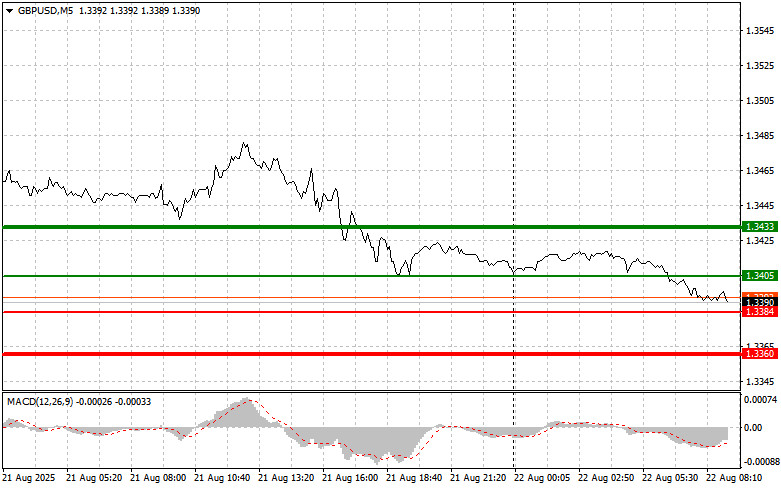

Scenario No. 1: I plan to buy the pound today upon reaching the entry point around 1.3405 (green line on the chart) with the target of rising to 1.3433 (thicker green line on the chart). Around 1.3433, I intend to exit long positions and open short positions in the opposite direction, expecting a move of 30–35 points downward from that level. Any rise in the pound today should be viewed only as a minor correction. Important! Before buying, make sure the MACD indicator is above the zero line and just beginning its upward move.

Scenario No. 2: I also plan to buy the pound today in case of two consecutive tests of the 1.3384 price level when the MACD indicator is in oversold territory. This would limit the pair's downside potential and trigger a reversal upward. Growth can then be expected toward the opposite levels of 1.3405 and 1.3433.

Sell Scenario

Scenario No. 1: I plan to sell the pound today after a breakout below 1.3384 (red line on the chart), which will likely trigger a quick decline. The key target for sellers will be 1.3360, where I intend to exit short positions and immediately open long positions in the opposite direction, expecting a move of 20–25 points upward from that level. Selling the pound today may be done within the framework of a new bearish market. Important! Before selling, ensure the MACD indicator is below the zero line and is just beginning its downward move.

Scenario No. 2: I also plan to sell the pound today in case of two consecutive tests of the 1.3405 price level when the MACD indicator is in overbought territory. This would limit the pair's upside potential and trigger a reversal downward. A decline can then be expected toward the opposite levels of 1.3384 and 1.3360.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.