The GBP/USD currency pair continued its upward movement on Wednesday, which had started the day before. Recall that on Tuesday, there were no strong fundamental reasons for a significant sell-off of the U.S. dollar. Technically, the inflation report did provide grounds for dollar selling, as it increased the probability of the Federal Reserve easing monetary policy in the near future. U.S. inflation slowed to 2.3%, close to the Fed's target level. However, as we've said before, inflation in 2025 cannot stay low. If it were that easy—raise import tariffs, prices remain flat, and the budget receives a windfall—then every country would be doing it: raising tariffs, taxes, and other payments into their budgets.

Yet some countries in the world—and institutions within those countries—don't believe inflation is always harmless. In Europe, the U.S., and other developed economies, it is widely accepted that the optimal growth rate occurs when inflation is around 2%. That is the level central banks strive to achieve. So, on one hand, the Fed should adopt a more dovish stance soon. On the other hand, inflation is expected to rise—if not in April, then in May.

Thus, once again, the market seized the opportunity to sell the dollar, which currently enjoys even less trust than Donald Trump. The American president continues to make decisions that, at best, confuse and at worst bewilder many politicians and economists. Doubts about the "Great Future of the U.S." are growing by the day, even despite the recent reduction in tariffs on Trump's so-called blacklist.

By the way, one simple question stands out: if Trump truly knows how to make America great again, why didn't he do it four years ago? Why did he lose to Biden? Why did he leave the White House amid chaos? And most importantly—what made Americans hand the reins back to a man with arguably one of the lowest approval ratings in U.S. history?

Still, America's problems are America's alone. Trump believes that devaluing the dollar will boost U.S. exports? That might have worked—if he hadn't alienated half the world. As we've noted, if global consumers actively avoid American products, no exchange rate will change that. For example, Tesla's sales in Europe have already plummeted by 70–80%.

Trump wants to bring U.S. factories back home? Great. He wanted that four years ago too. But major corporations don't want to pay massive taxes in the U.S., or spend three times more on labor and production than they would in China or Malaysia. That's why Apple is willing to move factories from China to India—but not back to the U.S. Other companies feel the same.

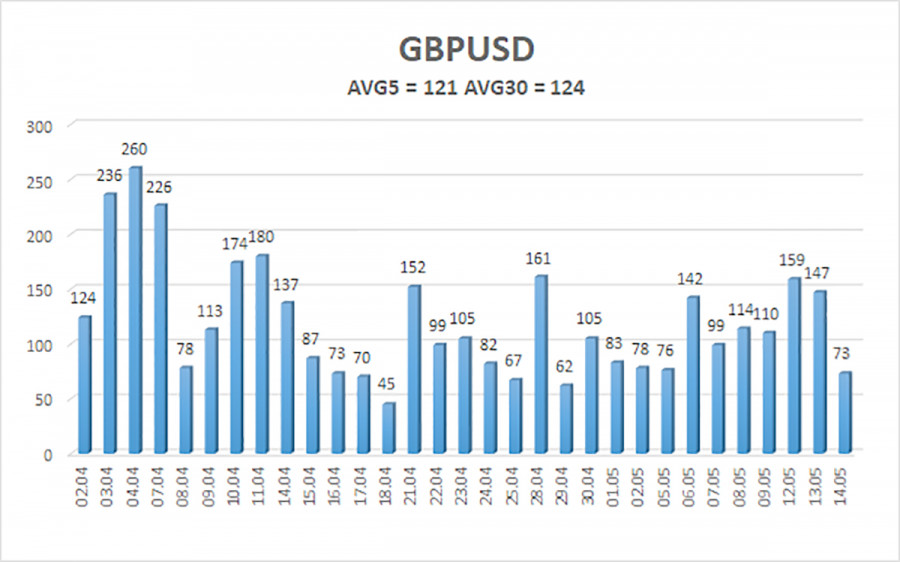

The average volatility of the GBP/USD pair over the last five trading days is 121 pips, which is considered "high." On Thursday, May 15, we expect the pair to move within the range of 1.3181 to 1.3423. The long-term regression channel remains upward-sloping, which still signals a bullish trend. The CCI indicator has formed a bearish divergence, which triggered the latest correction.

Nearest Support Levels:

S1 – 1.3184

S2 – 1.3062

S3 – 1.2939

Nearest Resistance Levels:

R1 – 1.3306

R2 – 1.3428

R3 – 1.3550

Trading Recommendations:

The GBP/USD pair maintains its bullish trend and has resumed a correction thanks to the trade agreements reached between China and the U.S. We still believe the pound has no fundamental basis for sustained growth. If the trade conflict continues to de-escalate—which currently seems likely—the dollar could return to the 1.2300–1.2400 area, where it began its Trump-driven collapse. However, given the market's reluctance to buy the dollar, that scenario is hard to believe. Therefore, we consider long positions unjustified in the context of the trade truce. If the price remains below the moving average, sell orders remain attractive, with targets at 1.3184 and 1.3062.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.