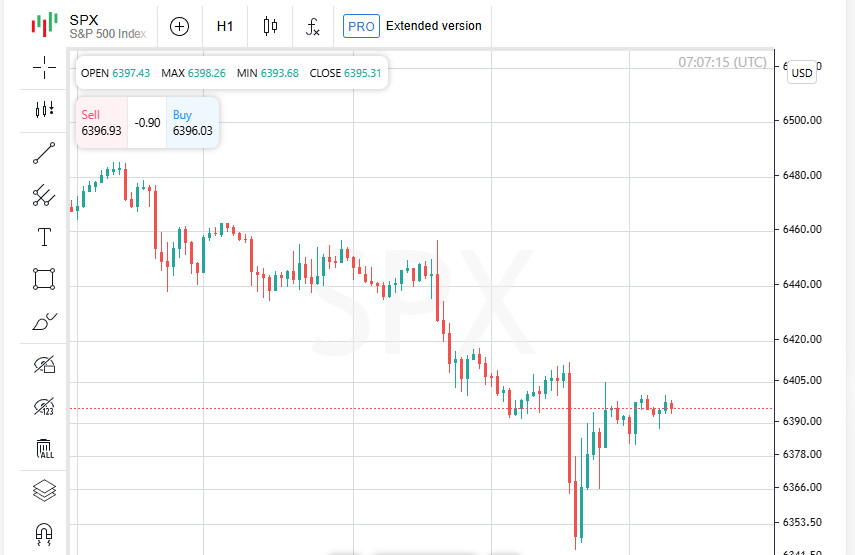

Tech stocks drag markets lower

On Wednesday, the Nasdaq and S&P 500 ended the session in negative territory as investors trimmed positions in technology shares and shifted funds toward more defensive sectors, while awaiting comments from Federal Reserve officials at the Jackson Hole symposium later this week.

Rotation into traditional industries

The sell-off hit companies that had been leading Wall Street's rebound since the spring downturn. The S&P 500's technology index slipped during the day, while sectors such as energy, healthcare, and consumer staples advanced, reflecting a rotation into areas considered less overvalued.

Questions about AI profitability

Market analysts pointed to additional reasons behind the tech pullback. OpenAI CEO Sam Altman recently warned that artificial intelligence stocks are caught in a "bubble." A study from the Massachusetts Institute of Technology also highlighted that many tech firms still struggle to turn AI innovations into sustainable profits.

Concerns over government intervention

Political uncertainty added to market jitters. President Donald Trump's administration is weighing the purchase of stakes in major chipmakers like Intel, only weeks after signing unprecedented revenue-sharing agreements with Nvidia and AMD. These developments reignited debate over the government's role in private industry.

Chipmakers under pressure

Shares of Nvidia, AMD, Intel, and Micron slipped as investors awaited Nvidia's quarterly results, due on August 27. The report is expected to shed light on the resilience of demand for artificial intelligence–related products.

Retail earnings in focus

This week's earnings from major retailers are seen as a key gauge of US consumer strength. Concerns over tariffs pushing up prices have weighed on consumer sentiment.

Challenges for Target and Estee Lauder

Target shares fell after the company appointed a new chief executive but left its full-year forecast unchanged at the reduced level announced in May. Cosmetics group Estee Lauder also faced declines after tariff-related pressures forced it to revise its profit outlook downward.

Dollar and Asia show mixed signals

On Thursday, the US dollar eased from a weekly peak, while Asian markets traded without a clear direction. Investors preferred caution ahead of several pivotal days tied to the Federal Reserve's annual symposium in Jackson Hole.

Spotlight on Jerome Powell

The gathering, beginning Thursday, will host central bankers from across the globe. All attention is on Friday's speech by Fed Chair Jerome Powell, as traders seek clues about a potential rate cut in September. Meanwhile, the Australian benchmark index advanced 0.9 percent, reaching a record high.

Asian markets ease

Asian equities posted mixed results on Thursday, with most indexes slipping modestly but staying close to recent highs. Japan's Nikkei, which had reached a historic peak on Tuesday, declined by 0.6 percent.

Seoul and Shanghai in the green

South Korea's KOSPI rose 0.7 percent, rebounding after touching a six-week low the previous day. The index still trades near its four-year high from late July. Mainland China's blue-chip stocks added 0.7 percent, while Hong Kong's Hang Seng edged down 0.1 percent.

Europe and Wall Street futures

Futures for the pan-European STOXX 50 advanced 0.1 percent. In the United States, Nasdaq futures gained 0.1 percent after the composite index slipped 0.7 percent a day earlier. S and P 500 futures held steady following a 0.2 percent drop in the cash index.

Political pressure on the Fed

President Donald Trump once again turned his attention to the Federal Reserve, pressing for tighter control. Similar attempts earlier this year unsettled markets and contributed to weakness in the dollar.

Currency and bonds

The dollar traded calmly this time. The dollar index stood at 98.281 on Thursday, holding just below the previous day's high of 98.441, the strongest level since August 12. US two-year Treasury yields, typically sensitive to monetary policy expectations, edged up to 3.7518 percent, while the ten-year benchmark held steady at 4.2926 percent.

Currency market steady

The US dollar traded almost unchanged, holding at 147.38 yen. The euro remained flat at 1.1645 dollars, while the British pound hovered near 1.3454 dollars.

Gold edges lower

Precious metals came under mild pressure as gold slipped 0.3 percent, bringing the price of an ounce down to around 3338 dollars. Investors stayed cautious amid global market uncertainty.

Oil futures extend gains

Brent crude futures added 0.5 percent to reach 67.16 dollars per barrel, extending the previous session's strong advance of 1.6 percent. US benchmark West Texas Intermediate also climbed 0.5 percent to 63.05 dollars, following a 1.4 percent gain on Wednesday.