Investors await key inflation figures on Wednesday and Thursday. S&P 500 +0.27%, Nasdaq +0.37%, Dow +0.43%. Nebius surged sharply after a $17.4 billion deal with Microsoft. UnitedHealth sees entry into the Medicare program list with the highest rating. Albemarle declined on concerns over reduced lithium supply.

Markets gain ahead of key inflation data

On Tuesday, the global MSCI equity index advanced, the dollar strengthened, and US Treasury yields moved higher. Investors are cautiously awaiting fresh inflation statistics against the backdrop of revised labor indicators in the US economy.

US labor market proves weaker than expected

The US Department of Labor reported that for the year ending in March, 911,000 fewer jobs were created in the economy than initially estimated. This confirms that employment growth had already slowed before Donald Trump's administration introduced harsh trade tariffs.

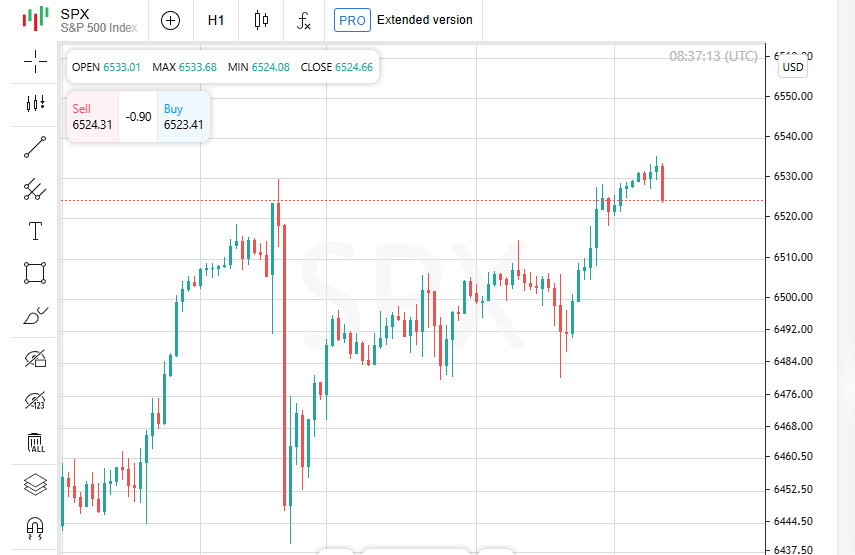

Wall Street sets new records

New York stock indices closed higher. The S&P 500 gained 17.46 points, or 0.27%, reaching a record high of 6,512.61. The Dow Jones added 196.39 points, or 0.43%, finishing at 45,711.34. The Nasdaq posted a second consecutive record, climbing by 80.79 points, or 0.37%, to 21,879.49.

Optimism in global markets

The MSCI international index rose by 2.22 points, or 0.23%, to 961.10. The European STOXX 600 showed a modest increase of 0.06%. Emerging-market equities gained 12.06 points, or 0.94%, reaching 1,294.26.

New prime minister in France

French President Emmanuel Macron appointed Sebastien Lecornu as the new head of government. This marks the fifth prime minister in less than two years. The decision came after the opposition united to oust center-right Francois Bayrou, whose budget-cutting initiatives sparked widespread discontent.

Political shifts around the world

Investors closely followed not only developments in Paris. In Asia, headlines were dominated by the resignation of Japan's prime minister, in Latin America by the defeat of Argentine President Javier Milei's party in regional elections, and in Indonesia by the unexpected replacement of the finance minister.

Argentine market under pressure

After a sharp plunge of more than 13% on Monday, Argentina's Merval index extended losses with another 0.3% decline on Tuesday.

Wall Street dynamics

UnitedHealth shares rose after the company said it expects a stable number of clients under leading Medicare programs. This increases the likelihood of higher government payments in favor of the insurer.

JPMorgan Chase shares gained 1.7%. The rise was linked to management's forecast that investment banking revenues would grow by double digits in the third quarter, while trading profits would also show a noticeable increase.

Technology sector weakens

Apple slipped by 1.5% after unveiling new iPhone models that failed to impress investors. Broadcom shares fell by 2.6% after a five-day rally that had significantly boosted the market capitalization of the world's second-largest chipmaker.

Focus on inflation and rates

Investors are preparing for a data-heavy week: the producer price inflation report is due Wednesday, followed by consumer price data on Thursday. These releases will help the market assess the consequences of Donald Trump's tariff policy and determine the likelihood of more decisive Fed action on rate cuts.

Nebius surge and competitors' gains

Nebius shares jumped by nearly 50% after the AI infrastructure developer signed a $17.4 billion contract with Microsoft. Rival CoreWeave also benefited, with its shares climbing by 7%.

Family reshuffle in the Murdoch empire

Fox Corp Class B shares fell by 6.7%, while News Corp dropped by 4.5%. The reason was a family agreement: Rupert Murdoch and his children agreed to hand control of the media empire to his eldest son, Lachlan.

Lithium market under pressure

Albemarle shares plunged by 11.5%. Investors expect Chinese CATL to resume production at its lithium mine, easing concerns over supply disruptions and putting pressure on the US producer's stock.

Oracle surprises with earnings

Following its quarterly report, Oracle shares surged by 12% in after-hours trading, sending a strong signal to the technology sector.

Asia follows Wall Street higher

On Wednesday, Asian stock markets closed in positive territory, tracking gains in the US. At the same time, bonds, traditionally seen as a safe haven, lost value. Traders increased bets that weakness in the US labor market will push the Federal Reserve to cut the benchmark rate by at least a quarter point as early as next week.

Regional leaders of rally

Japan's Nikkei rose by 0.8%. South Korea's KOSPI jumped by 1.7%. Taiwan's index gained 1.5%, setting a new all-time high.

China and Hong Kong in green

Hong Kong's Hang Seng index added 1.3%, while the mainland benchmark CSI300 climbed by 0.3%.

Japanese bonds correct slightly

The yield on Japanese government bonds of equivalent maturity rose by 0.5 basis points to 1.565%. This followed a minor correction after a successful five-year auction, which temporarily cooled the previous rally.

Dollar eases slightly

The US dollar index, which tracks the currency against a basket of six global counterparts, edged down to 97.707 on Thursday, erasing its recent small gains.

Currency moves

The dollar was little changed against the euro at 1.1715 per euro. Against the Japanese yen, it slipped by 0.07% to 147.31.

Awaiting BoJ decision

Next week promises to be eventful: on Friday, the Bank of Japan will release the outcome of its latest monetary policy meeting. Experts believe that the regulator will likely refrain from raising the key interest rate this time.

Precious metals advance

Gold rose by 0.5% to settle at $3,644 per ounce, after climbing to a record $3,673.95 the previous day.

Oil prices gain

Brent futures added 1.1% to $67.13 per barrel. US WTI contracts also gained 1.1%, reaching $63.34.