Trade Review and Tips for Trading the Euro

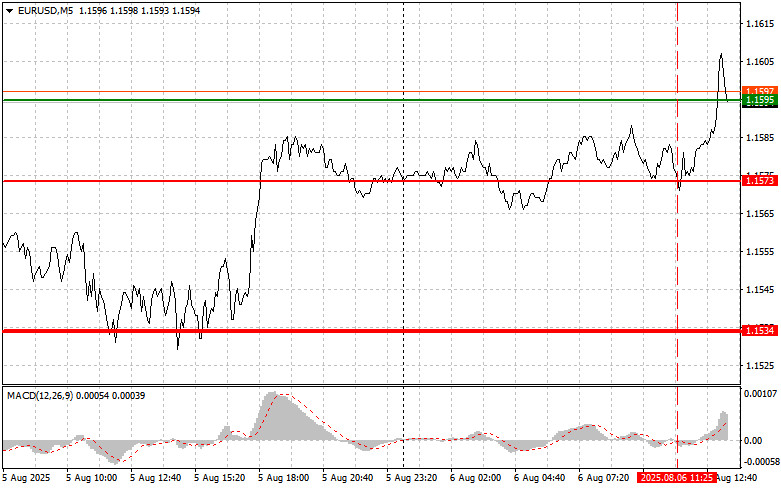

The test of the 1.1573 price level occurred when the MACD indicator had just started moving downward from the zero mark, confirming a valid entry point for selling the euro. However, the pair failed to decline afterward.

Despite unfavorable economic news from Germany and the entire eurozone, the euro demonstrated resilience. The data revealed a decline in industrial orders in Germany, a warning sign for Europe's largest economy and its industrial backbone. Retail sales in the eurozone also fell short of expectations. Going forward, euro movement will depend on incoming economic data and comments from ECB and Fed representatives. Investors will closely analyze signs of either strengthening or weakening in the eurozone economy to assess growth prospects and potential regulatory actions.

As for statements from Fed officials, several are expected today. Focus should be on speeches by members of the Federal Open Market Committee—Susan M. Collins, Lisa D. Cook, and Mary Daly. Traders and analysts will closely monitor their remarks for clues about the timing and scale of further interest rate cuts. Any indication that the Fed is prepared to return to a more accommodative stance could significantly impact the U.S. dollar and other financial instruments. In particular, remarks by Susan M. Collins, President of the Federal Reserve Bank of Boston, may shed light on her strategy for tackling inflation amid ongoing global economic instability due to tariffs. Lisa D. Cook, member of the Fed's Board of Governors, might offer more detailed insights into labor market conditions, while Mary Daly, President of the San Francisco Fed, is likely to share her views on regional economic prospects and the global policy outlook.

For intraday strategy, I will focus primarily on implementing Scenarios 1 and 2.

Buy Signal

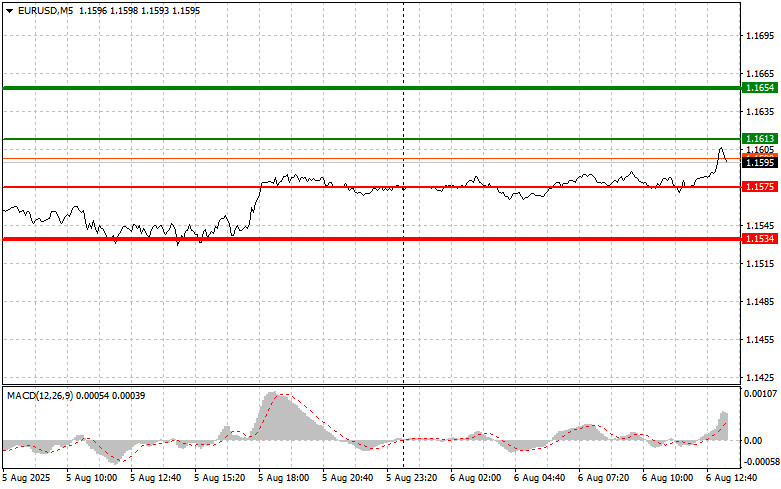

Scenario 1: I plan to buy EUR/USD today after the price reaches around 1.1613 (green line on the chart), targeting a rise to 1.1654. At 1.1654, I will close long positions and consider opening short positions in the opposite direction, aiming for a 30–35 point correction. A strong upward move in the euro is likely if the Fed signals a very dovish stance. Important: Before entering a buy trade, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario 2: I also plan to buy EUR/USD today in case of two consecutive tests of the 1.1575 level, provided that the MACD is in oversold territory. This would limit the pair's downward potential and trigger a reversal to the upside. Targets would be 1.1613 and 1.1654.

Sell Signal

Scenario 1: I plan to sell EUR/USD after the price reaches 1.1575 (red line on the chart), targeting a decline to 1.1534. At this level, I will exit short positions and consider long entries, aiming for a 20–25 point rebound. Downward pressure is likely to increase if the Fed adopts a more hawkish tone. Important: Before entering a sell trade, ensure that the MACD is below the zero line and just beginning to decline.

Scenario 2: I also plan to sell EUR/USD today in case of two consecutive tests of the 1.1613 level while the MACD is in overbought territory. This would cap the pair's upward potential and trigger a reversal downward. Targets would be 1.1575 and 1.1534.

Chart Key:

- Thin green line – Entry price for buying the instrument;

- Thick green line – Suggested take-profit level or point to manually close long positions, as further growth above this level is unlikely;

- Thin red line – Entry price for selling the instrument;

- Thick red line – Suggested take-profit level or point to manually close short positions, as further decline below this level is unlikely;

- MACD indicator – Use overbought/oversold zones as entry signals.

Important Note for Beginners

Forex beginners must approach market entries with extreme caution. It's best to stay out of the market before key fundamental reports to avoid being caught in sharp price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you risk quickly losing your entire deposit—especially when trading large volumes without proper money management.

And remember: successful trading requires a clear trading plan, like the one provided above. Making spontaneous trading decisions based solely on current market conditions is a fundamentally losing strategy for intraday traders.