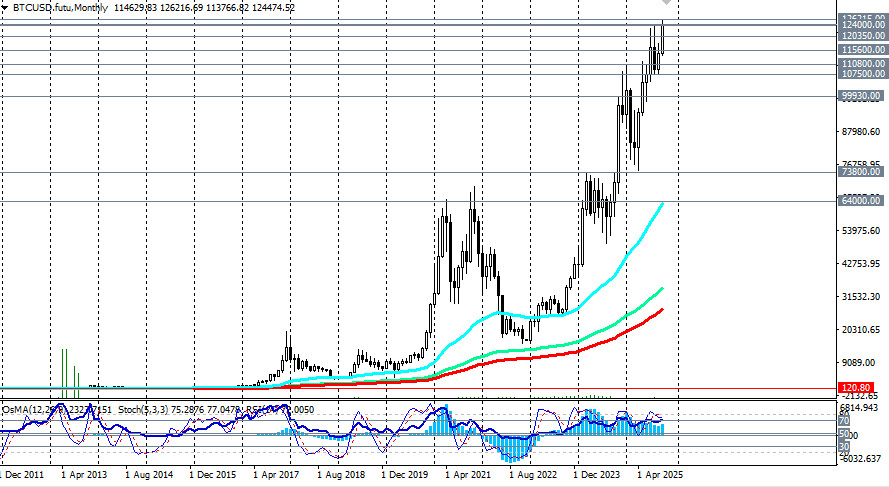

The macroeconomic environment, sustained institutional demand, and expectations of a dovish Federal Reserve make the scenario of Bitcoin reaching new all-time highs in Q4 the base case. In any event, the forecast for BTC in Q4 2025 points to confident growth.

Despite high volatility, Bitcoin managed to hold onto yesterday's gains, while today the US dollar continues its positive momentum, with the USDX index trading slightly above yesterday's high at 98.47.

At the same time, market uncertainty remains elevated, driven by a mix of opposing factors, prompting investors to be cautious — both in buying and selling the dollar.

Meanwhile, demand for traditional safe-haven assets such as silver and, to a greater extent, gold remains high, preventing prices from declining significantly from the recent record highs.

In contrast to traditional markets, the cryptocurrency market appears to be dominated by optimism.

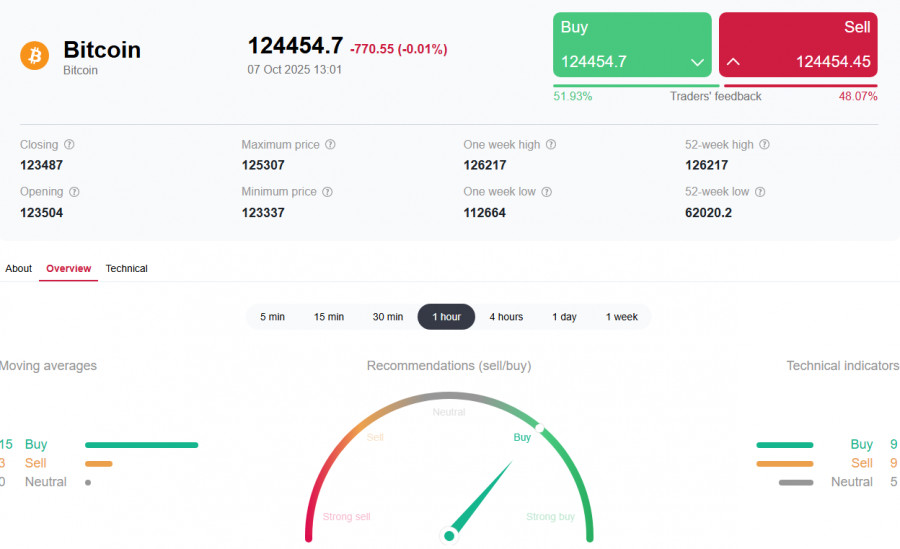

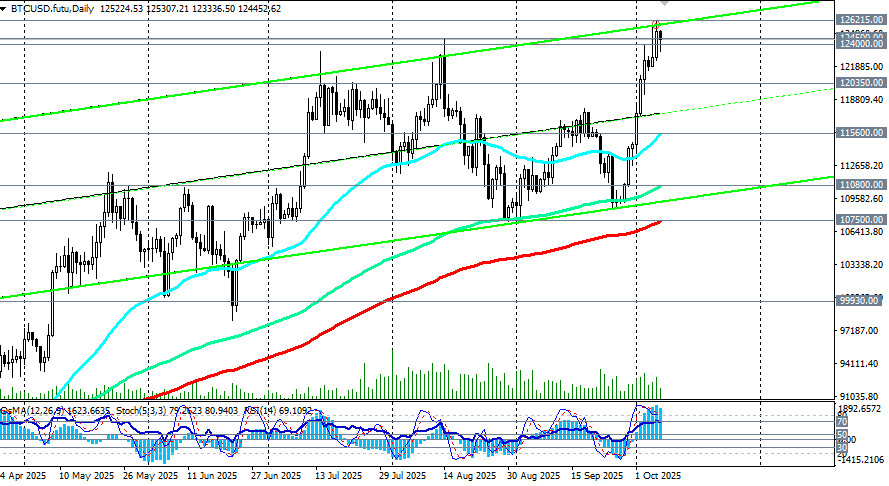

Yesterday, Bitcoin reached a new record high of $126,200.

Leading the gains in recent months is Binance Coin (BNB) — the BNB/USD pair is now testing the $1,290 level. Since the start of the year, this represents a gain of +84%.

The native token of Binance's BNB Chain has been growing for three consecutive years, tripling in value over that time.

Nearly all top-10 cryptocurrencies by market cap have shown positive performance since the beginning of October. As for Bitcoin, it has risen 10% month-to-date, gaining about $11,500 per coin.

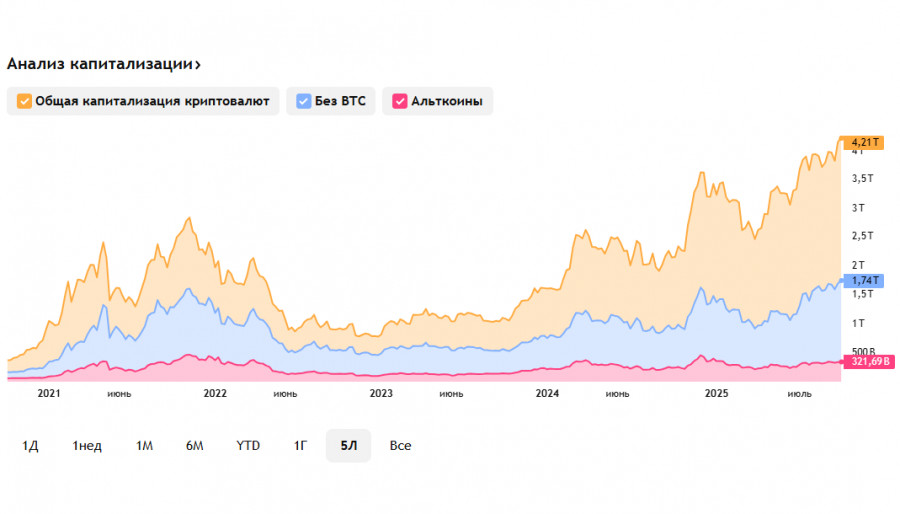

Despite a 0.12% drop in total crypto market capitalization over the past 24 hours to $4.214 trillion (according to TradingView), this is only a mild correction from recent record highs. Since the start of the month, total crypto market cap has increased by 8.2%, up from $3.9 trillion.

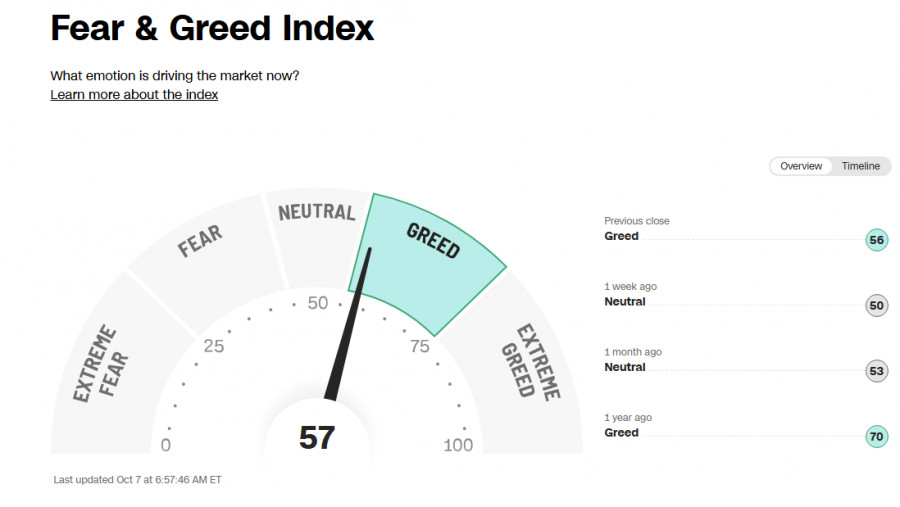

Meanwhile, the so-called "Crypto Fear and Greed Index" has shifted back into the "Greed" zone, currently sitting at 57 out of 100, indicating continued investor interest in buying cryptocurrencies.

Although some crypto market experts believe the peak of the current bull cycle may have already passed or is near, and are anticipating a transition to a bear market, the majority still expect Bitcoin to remain the main driver of crypto market dynamics throughout Q4. Popular altcoin tokens are also expected to demonstrate accelerated growth. Historically, Q4 has been a favorable period for cryptocurrency gains — as we noted in our recent report "Crypto Market Outlook: Q4 Forecast."

The crypto market is extending its bullish momentum, supported by several key factors:

1. Inflow of capital into ETFs

The primary driver of the current rally is the steady inflow of capital from institutional investors, especially from US buyers. Spot ETFs on leading cryptocurrencies like Bitcoin and Ethereum have seen significant inflows:

US Bitcoin ETFs attracted $3.24 billion last week — the highest weekly figure since November 2024.

The first three days of October alone brought in nearly $2.3 billion to Bitcoin ETFs.

Ethereum-focused funds saw inflows of $1.3 billion over the same week.

2. Positive sentiment and institutional adoption

Public figures and politicians are increasingly expressing support for Bitcoin. Eric Trump, son of former President Donald Trump, stated that cryptocurrency could solve problems in the financial system and "save the U.S. dollar." Such comments build investor confidence and foster a "fear of missing out" (FOMO). Digital assets are becoming more deeply integrated into traditional finance — a clear sign of growing institutional adoption.

3. Macroeconomic factors

The US government shutdown, which halted operations of federal agencies and suspended the publication of key macroeconomic data, has made it difficult for the Fed to assess inflation and employment trends. Without access to current data, market participants struggle to make informed decisions and increasingly turn to non-dollar assets.

Amid this high uncertainty, expectations of monetary policy easing have grown. Markets are reacting to Donald Trump's pressure on the Fed, pricing in a 97% chance of a rate cut in October, with two rate cuts expected by the end of the year.

Risks to the US dollar, along with potential new stimulus measures, including targeted cash payments, are boosting interest in Bitcoin as a safe-haven asset.

Forecasts and resistance levels

Analysts forecast that Bitcoin could reach $135,000 by year-end. At the current pace of growth, that target may be reached sooner.

October is historically marked by increased volatility, active trading, and rising volumes.

The key resistance level for Bitcoin is seen in the $129,000–$130,000 range, where a significant amount of sell orders is concentrated. A breakout above this level could open the path to $135,000–$140,000.

Overall outlook

The macroeconomic backdrop, strong institutional demand, and expectations of a dovish Fed make new all-time highs in Q4 the base case for Bitcoin. Either way, the Q4 2025 BTC forecast suggests confident and continued growth.