Trade Review and Trading Tips for the British Pound

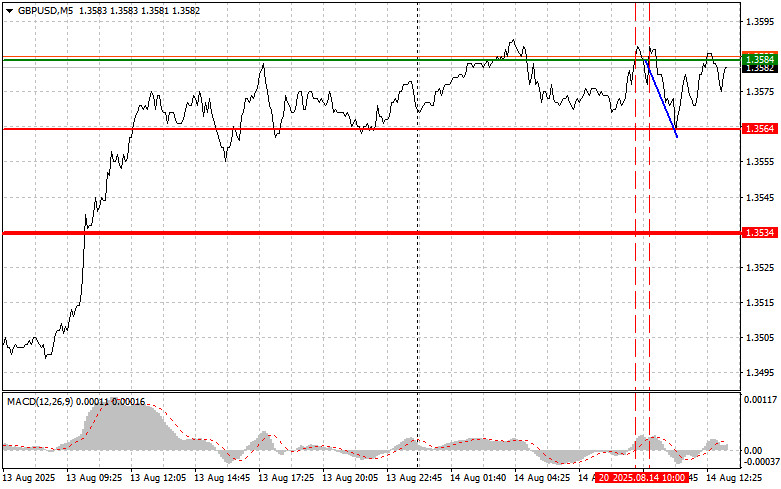

The price test of 1.3584 occurred when the MACD indicator had already moved significantly above the zero mark, limiting the pair's upward potential. For this reason, I did not buy the pound. The second test of 1.3584 took place when the MACD was in the overbought zone, which allowed scenario #2 for selling to play out, resulting in a 20-point drop in the pair.

UK GDP growth of 0.4% immediately triggered pound buying. Such a surge of optimism, driven by unexpectedly strong macroeconomic data, is a classic foreign exchange market reaction. Investors encouraged by the prospects of faster economic growth tend to purchase assets denominated in the national currency — in this case, the British pound. However, the sustainability of this rise depends on several factors. First, it is important to assess whether this momentum is long-term. Was it a one-off spike caused by seasonal factors, or is it the beginning of a stable recovery trend following the end of the trade war cycle with the U.S.? Second, the Bank of England's reaction matters. Will it see this data as a reason to adopt a wait-and-see approach, or will it continue to cut rates?

Today, a noteworthy speech by FOMC member Thomas Barkin is expected. Recently, Fed officials have been increasingly split into two camps, so his remarks will be important. Some continue to insist on keeping rates unchanged for longer to ensure victory over inflation, regardless of risks to economic growth. They highlight the resilience of the labor market and ongoing inflationary pressures in the services sector. Others urge caution, pointing to signs of economic slowdown and potential labor market instability, with recent data alarming many economists. In this context, Barkin's stance is especially interesting. He is known as a moderate policymaker seeking a balanced approach. His assessment of the current situation and outlook on the Fed's next steps could be crucial in shaping consensus within the committee.

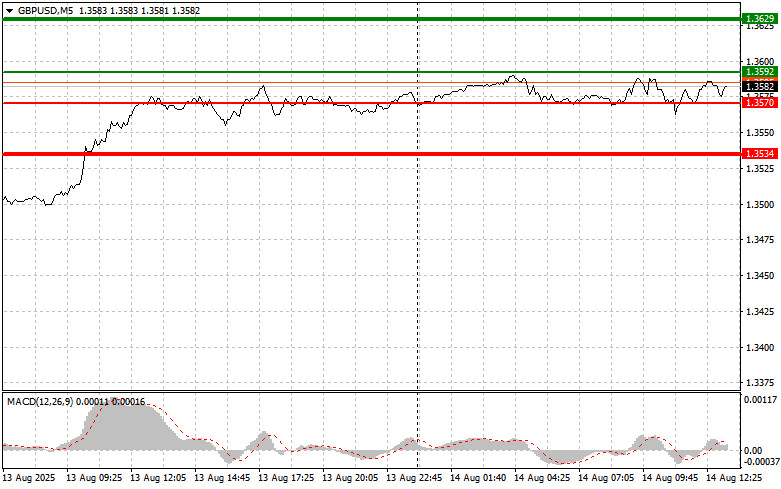

As for the intraday strategy, I will mainly rely on scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy the pound upon reaching the entry point around 1.3592 (green line on the chart) with a target at 1.3629 (thicker green line on the chart). Around 1.3629, I will exit long positions and open short positions in the opposite direction, expecting a 30–35-point move down from that level. Pound growth can be expected to continue within the current bullish market. Important: Before buying, make sure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of 1.3570 while the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to an upward reversal. A rise toward the opposite levels of 1.3592 and 1.3629 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after the price breaks below 1.3570 (red line on the chart), which should lead to a rapid decline. The key target for sellers will be 1.3534, where I will exit short positions and immediately open long positions in the opposite direction, expecting a 20–25-point move upward. Sellers will be active today if strong statistics are released. Important: Before selling, make sure the MACD indicator is below the zero mark and just starting to fall from it.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of 1.3592 while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward reversal. A drop toward the opposite levels of 1.3570 and 1.3534 can be expected.

Chart Legend:

- Thin green line – entry price for buying the trading instrument;

- Thick green line – projected level for setting Take Profit or fixing profit manually, as further growth above this level is unlikely;

- Thin red line – entry price for selling the trading instrument;

- Thick red line – projected level for setting Take Profit or fixing profit manually, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to follow overbought and oversold zones.

Important: Beginner Forex traders should be very cautious when deciding to enter the market. Before the release of major fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you ignore money management and trade large volumes.

Remember, successful trading requires a clear trading plan, like the one provided above. Making spontaneous decisions based on the current market situation is inherently a losing strategy for intraday traders.