Analisis Dagangan dan Petua untuk Berdagang Pound British

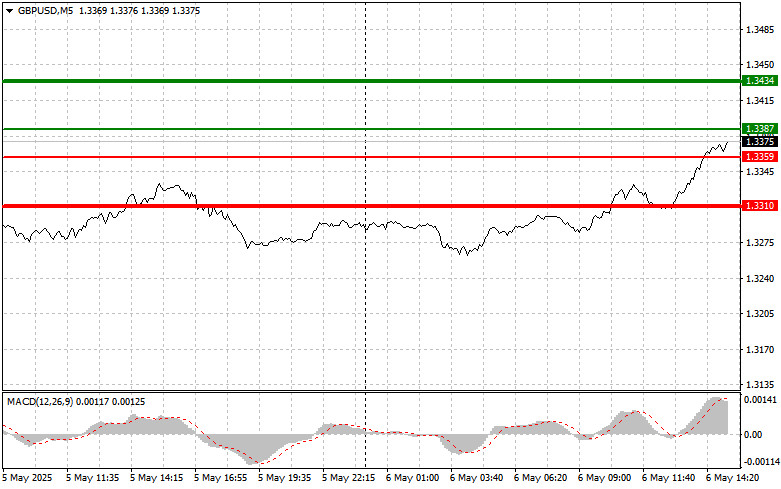

Ujian paras harga 1.3308 pada separuh pertama hari ini berlaku ketika penunjuk MACD telah pun bergerak dengan ketara melepasi tanda sifar, yang mengehadkan potensi kenaikan pasangan mata wang ini. Atas sebab itu, saya tidak membeli pound dan terlepas keseluruhan pergerakan menaik tersebut.

Data PMI bagi sektor perkhidmatan UK telah disemak naik, yang mendorong pengukuhan pound berbanding dolar. Perkembangan ini menjadi kejutan yang menggembirakan bagi peserta pasaran yang sebelum ini bimbang terhadap kelembapan ekonomi UK yang lebih ketara. Angka PMI yang bertambah baik menunjukkan bahawa sektor perkhidmatan — pemacu utama ekonomi British — lebih berdaya tahan daripada jangkaan. Perkara ini seterusnya mengurangkan kebimbangan terhadap kemungkinan berlakunya kemelesetan dan menyokong keyakinan pelabur terhadap pound Britain.

Sepanjang sesi dagangan AS, angka imbangan dagangan Amerika Syarikat dijangka akan diterbitkan. Keputusan yang lemah, yang mungkin berpunca daripada tarif perdagangan, boleh menyebabkan kejatuhan dolar. Para pelabur dan penganalisis meneliti data ini dengan teliti kerana ia merupakan penunjuk penting terhadap keadaan ekonomi AS dan daya saing globalnya. Peningkatan dalam defisit dagangan boleh menjadi isyarat kepada penurunan permintaan terhadap barangan dan perkhidmatan AS, yang memberi kesan negatif terhadap pertumbuhan ekonomi. Kesan tarif perdagangan ke atas imbangan dagangan masih menjadi topik perbincangan aktif. Di satu pihak, tarif bertujuan melindungi pengeluar domestik dan merangsang pembuatan tempatan. Namun di pihak lain, ia boleh menaikkan kos barangan import, mengurangkan daya saing syarikat AS dan memburukkan lagi imbangan dagangan.

Bagi strategi dagangan intraday, saya akan memberi tumpuan utama kepada pelaksanaan Senario #1 dan #2.

Isyarat Beli

Senario #1: Saya merancang untuk membeli pound hari ini pada titik kemasukan sekitar 1.3387 (garis hijau pada carta) dengan sasaran kenaikan ke paras 1.3434 (garis hijau tebal pada carta). Di sekitar paras 1.3434, saya merancang untuk menutup kedudukan beli dan membuka kedudukan jual dalam arah bertentangan (dengan jangkaan lantunan semula sebanyak 30–35 mata). Kenaikan pound hari ini berkemungkinan hanya berlaku sekiranya data AS adalah lemah. Penting! Sebelum membeli, pastikan penunjuk MACD berada di atas paras sifar dan baru mula naik daripadanya.

Senario #2: Saya juga merancang untuk membeli pound hari ini sekiranya terdapat dua ujian berturut-turut pada paras harga 1.3359 ketika penunjuk MACD berada dalam zon terlebih jual (oversold). Keadaan ini akan mengehadkan potensi penurunan pasangan dan mencetuskan pembalikan arah ke atas. Kenaikan ke paras 1.3387 dan 1.3434 boleh dijangkakan.

Isyarat Jual

Senario #1: Saya merancang untuk menjual pound selepas penembusan ke bawah paras 1.3359 (garis merah pada carta), yang berkemungkinan akan mencetuskan kejatuhan mendadak pasangan ini. Sasaran utama bagi penjual ialah paras 1.3310, di mana saya merancang untuk menutup kedudukan jual dan segera membuka kedudukan beli (dengan jangkaan lantunan semula sebanyak 20–25 mata). Penjual dijangka akan bertindak sekiranya data dari AS adalah kukuh. Penting! Sebelum menjual, pastikan penunjuk MACD berada di bawah paras sifar dan baru mula menurun daripadanya.

Senario #2: Saya juga merancang untuk menjual pound hari ini sekiranya terdapat dua ujian berturut-turut pada paras 1.3387 ketika penunjuk MACD berada dalam zon terlebih beli (overbought). Keadaan ini akan mengehadkan potensi kenaikan pasangan dan mencetuskan pembalikan arah ke bawah. Penurunan ke paras 1.3359 dan 1.3310 boleh dijangkakan.

Paparan Utama Carta:

- Garisan Hijau Nipis – harga masuk untuk membeli instrumen dagangan.

- Garisan Hijau Tebal – harga sasaran, di mana anda boleh menetapkan Ambil Untung (TP) atau keuntungan boleh ditetapkan secara manual, kerana pertumbuhan selanjutnya di atas tahap ini adalah tidak mungkin.

- Garisan Merah Nipis – harga masuk untuk menjual instrumen dagangan.

- Garisan Merah Tebal – harga sasaran, di mana anda boleh menetapkan Ambil Untung (TP) atau keuntungan boleh ditetapkan secara manual, kerana pertumbuhan selanjutnya di atas tahap ini adalah tidak mungkin.

- Penunjuk MACD: Adalah penting untuk mempertimbangkan zon terlebih beli dan terlebih jual semasa memasuki pasaran

Penting: Pedagang baharu dalam pasaran Forex harus berhati-hati ketika membuat keputusan untuk memasuki pasaran. Sebaiknya elakkan berdagang sebelum laporan asas utama diterbitkan bagi mengelakkan pergerakan harga yang mendadak. Jika anda memilih untuk berdagang semasa siaran berita, pastikan sentiasa menetapkan pesanan henti rugi (SL) bagi mengurangkan kerugian. Tanpa pesanan henti, anda berisiko kehilangan keseluruhan deposit dengan cepat — terutamanya jika berdagang dalam volum besar tanpa pengurusan risiko yang betul.

Perlu diingat, dagangan yang berjaya memerlukan pelan dagangan yang jelas, seperti yang telah dinyatakan di atas. Keputusan spontan yang dibuat semata-mata berdasarkan pergerakan semasa pasaran sering kali membawa kepada kerugian bagi pedagang intraday.