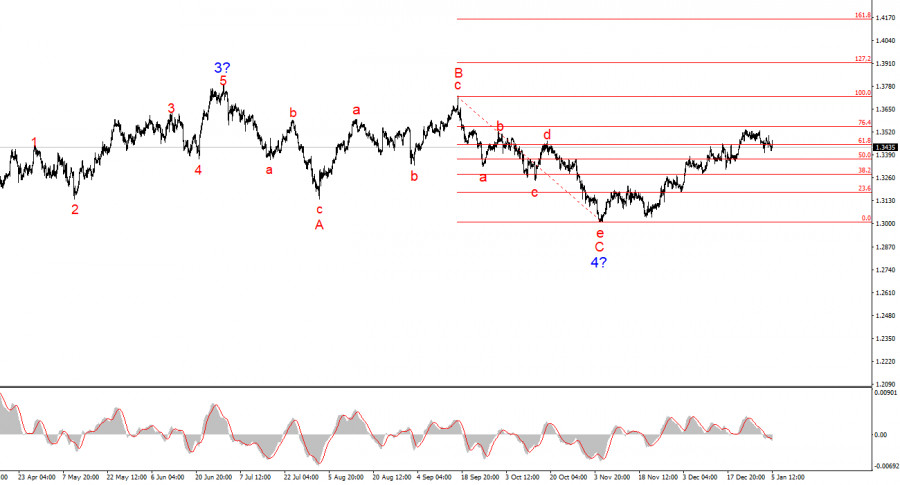

For GBP/USD, the wave count continues to indicate the construction of an upward trend segment (lower chart), but over the past six months it has taken on a complex corrective form (upper chart). The trend segment that began on July 1 can be considered Wave 4, or any global corrective wave, since it clearly has a corrective rather than an impulsive internal structure. The same applies to its internal subwaves. The downward wave structure that started on September 17 took the form of a five-wave pattern a–b–c–d–e and has been completed. The pair is now in the process of forming a new upward wave sequence.

Of course, any wave structure can become more complex at any moment and take on a more extended form. Even the presumed Wave 4 could still evolve into a five-wave structure, in which case we would observe correction for several more months. Therefore, the market is currently at a bifurcation point: either Wave 4 has been completed and a prolonged rise will follow, or a new corrective wave structure will begin, with a decline below the 1.3000 level.

The GBP/USD rate lost virtually nothing by the start of the U.S. session on Monday. Events in Venezuela had a strong impact on EUR/USD, but almost none on GBP/USD. Based on this decoupling, I am prepared to assume that both instruments will undergo reverse synchronization in the near future. The news background is the same for both, so it is rather strange to see the euro falling while the pound remains resilient.

I also do not believe that the "Maduro factor" will have a long-term positive effect on the U.S. dollar. Essentially, this event has already taken place and will not generate any particularly interesting follow-up for participants in the currency market. In the near future, the new Venezuelan authorities will try to establish dialogue with Donald Trump, and the fate of Nicolas Maduro has already been decided. It does not matter whether he spends the rest of his days in prison or is executed. He is no longer the president of Venezuela, and the country is opening a new chapter in its history. Therefore, I do not expect further strengthening of the U.S. currency during the remainder of this week.

It is also worth recalling that the dollar itself remains in a rather unfavorable and unattractive position due to an "overcooled" labor market. The Federal Reserve is not yet ready for a new round of monetary easing, but this week's economic data may, if not change the views of Fed policymakers, then at least reinforce their dovish bias for 2026. In any case, pressure on the U.S. currency may intensify. Unfortunately, wave analysis does not provide much help at the moment in determining the trend for the coming weeks. In the second half of 2025, we observed alternating corrective structures, and it is still unclear whether the market is ready to transition into a trend.

General Conclusions

The wave picture for GBP/USD has changed. The downward corrective structure a–b–c–d–e within Wave C of Wave 4 appears complete, as does Wave 4 itself. If this is indeed the case, I expect the main trend segment to resume its development with initial targets around the 1.3800 and 1.4000 levels.

In the short term, I expected the construction of Wave 3 or c with targets around 1.3280 and 1.3360, which correspond to the 76.4% and 61.8% Fibonacci levels. These targets have been reached. Wave 3 or c has presumably completed its formation, so in the near future we may see the development of a downward wave or a set of downward waves.

The higher-timeframe wave count looks almost ideal, even though Wave 4 moved beyond the high of Wave 1. However, let me remind you that ideal wave counts exist only in textbooks. In practice, everything is far more complex. At the moment, I see no reason to consider alternative scenarios to the upward trend segment.

Core Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often imply changes.

- If there is no confidence in what is happening in the market, it is better not to enter it.

- There is no such thing as 100% certainty about market direction and never will be. Do not forget to use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.