Analysis of Trades and Trading Tips for the Euro

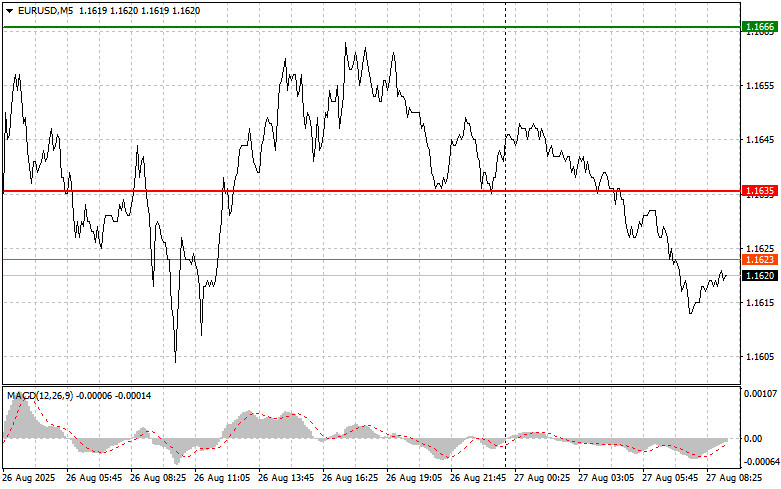

Due to low volatility, there were no tests of the levels I indicated in the second half of the day. For this reason, I remained without any trades.

Yesterday, the rise in the index reflecting US consumer confidence once again stimulated interest in the US dollar. However, since it only came in above forecasts but below the previous value, this did not lead to any significant strengthening of the US currency. The improvement in consumer sentiment influenced investor perceptions, who once again saw signs of stability in the US economy. However, the situation in the forex market during the summer remains complex and is dependent on numerous factors.

Today, the only economic report of interest is the GfK Consumer Sentiment Index from Germany. If its value comes out below expectations, the euro's decline may accelerate. Traders will closely monitor this indicator, as it provides valuable insight into the confidence of German consumers and their inclination toward future spending. A decrease in consumer confidence may signal a slowdown in Germany's economic development, which will undoubtedly impact the euro's position. In the context of US trade tariffs, German economic data assumes special significance.

As the largest economy in Europe, Germany has a significant influence on the overall economic condition of the eurozone. Unsatisfactory data from Germany could trigger a domino effect, worsening growth prospects for other EU countries. Alongside the GfK index, the market will also analyze statements from representatives of the European Central Bank. Any hints of a possible further rate cut may add pressure on the euro.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

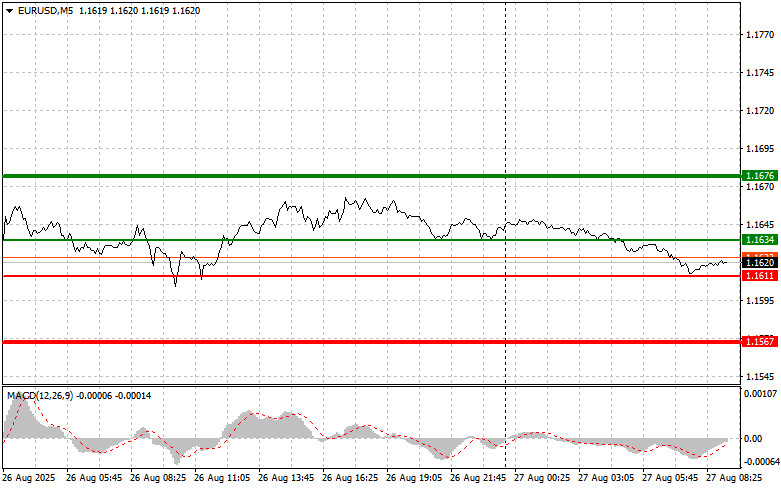

Scenario #1: Today, I will buy the euro if the price reaches the area around 1.1634 (green line on the chart) with a target of rising to 1.1676. At 1.1676, I plan to exit the market and also sell the euro in the opposite direction, expecting a move of 30–35 pips from the entry point. Any euro growth can only be expected as a correction. Important! Before buying, ensure the MACD indicator is above zero and is just starting to rise from this level.

Scenario #2: I also plan to buy the euro today in the event of two consecutive tests of the 1.1611 price while the MACD indicator is in the oversold area. This will limit the downside potential for the pair and lead to an upside reversal. A rise to the opposite levels of 1.1634 and 1.1676 can be expected.

Sell Scenario

Scenario #1: I plan to sell the euro after the price reaches the 1.1611 level (red line on the chart). The target is 1.1567, where I plan to exit the market and immediately buy in the opposite direction (expecting a move of 20–25 pips in the opposite direction from the level). Pressure on the pair can return at any time today. Important! Before selling, ensure the MACD indicator is below zero and is just starting to decline from this level.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.1634 price while the MACD indicator is in the overbought area. This will cap any upside potential for the pair and lead to a downside reversal. A decline towards the opposite levels of 1.1611 and 1.1567 can be expected.

What's on the Chart:

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.