On Wednesday, as expected, the Federal Reserve left all parameters of its monetary policy unchanged, but this did not disappoint market participants. On the one hand, this was anticipated; on the other, Donald Trump's new victory in the trade war on the Far Eastern front gave the markets another boost of optimism.

The U.S. central bank kept its key interest rate unchanged, specifically within the 4.25–4.50% range. During the press conference following the meeting, Fed Chair Jerome Powell did not hint at the possibility of a rate cut at the next meeting scheduled for September 16–17. He once again justified the Fed's decision by pointing to the ongoing uncertainty surrounding tariff wars—likely alluding to the fact that America's major trading partners, China and India, are still reluctant to pledge loyalty to the hegemon and pay tribute to their suzerain.

However, market participants did receive one important signal: two members of the Federal Open Market Committee (FOMC) expressed dissent from Powell's stance, indicating they would support a rate cut.

Meanwhile, Trump's victorious month in tariff confrontations with trade partners continues. Yesterday, he announced a trade agreement with South Korea, which includes a 15% import tariff on goods from that country. Additionally, the U.S. President compelled this U.S. ally to invest 350 billion dollars into the American economy. The agreement also provides for the purchase of liquefied natural gas and other energy products—of course, not at low prices. In essence, the U.S., through its leader, continues to exploit its satellite states, forcing them to finance America's economic problems through financial contributions and predatory import duties.

It remains to be seen who will be next in line.

Trump is hinting that India should follow the path of compliant satellite states and pay for America's greatness. Whether this happens or not is still unclear. For now, markets are reacting to this news using the familiar playbook. For them, clarity is a key factor.

On this wave, futures on major U.S. stock indices are trading significantly higher, particularly the tech-heavy NASDAQ 100 and the broader S&P 500 index.

Clarification regarding how trade agreements between the U.S. and its partners will be concluded is supporting the dollar, which has been under pressure since the beginning of the year due to concerns about a potential U.S. recession and uncertainty over the global consequences of Trump's widespread trade wars. Against this backdrop, the U.S. dollar index is confidently rising and approaching a key resistance level at 100.00 points.

Another reason supporting the dollar is the weakening of the euro, which makes up a significant portion of the dollar index basket. As mentioned earlier, the euro has come under pressure due to the final tariff agreement between the EU and the U.S., which effectively implies a significant capital outflow from Europe to America, reducing the chances of economic recovery in the region.

What to Expect in the Markets Today?

I believe the rally in U.S. equities will continue. The news of the agreement with South Korea, along with excellent earnings reports from tech companies, will support demand for stocks. The euro, along with the pound and other Forex currencies, will remain under pressure due to the strengthening dollar. The cryptocurrency market will likely continue to consolidate, as there is currently a favorable environment for equities to grow. The commodity market also appears poised for growth amid greater clarity in the U.S. trade standoff with its partners.

Assessing the market landscape, I believe that overall positive sentiment will dominate through the end of the current week.

Forecast of the Day

EUR/USD

The pair remains under heavy pressure due to several factors described above. Its technical inability to rise above the 1.1450 mark will likely lead to a renewed decline toward 1.1330. A suitable level for initiating a sell position could be around 1.1428.

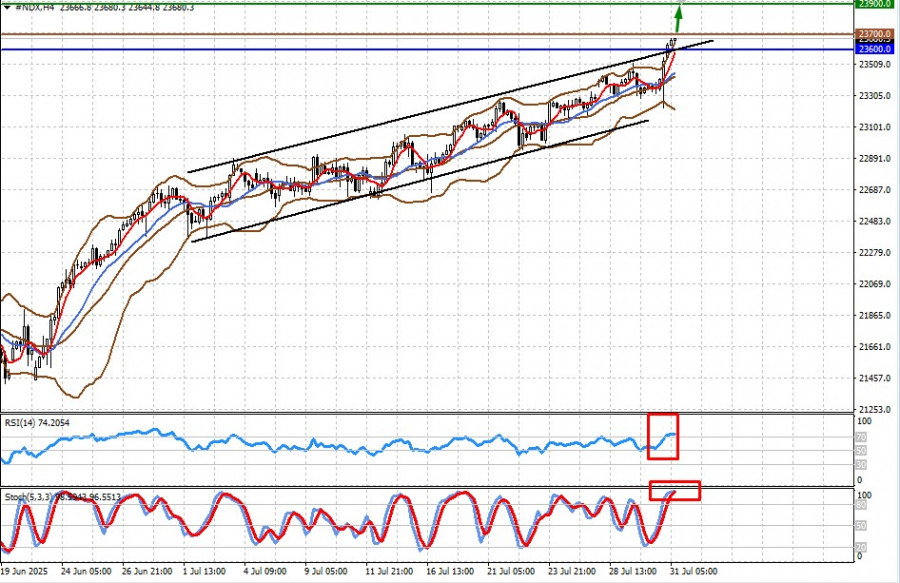

#NDX

The CFD contract on the NASDAQ 100 futures is steadily climbing. The overall wave of optimism will continue to support demand for tech-sector stocks, which in turn will drive the contract upward, potentially reaching 23,900. A suitable level for opening a long position could be around 23,700.