Last week, Christine Lagarde spoke three times. This week, she is scheduled to speak three more times. It may seem that every appearance by the European Central Bank president should trigger a strong market reaction, but in reality, not every speech captures the market's attention. Only those in which her rhetoric regarding key economic indicators or monetary policy changes meaningfully from prior statements tend to matter.

Last week, Lagarde made it clear that the current level of inflation in the Eurozone is acceptable to the ECB. This was a very important statement, allowing for a straightforward conclusion: the ECB does not intend to change its monetary policy parameters anytime soon. Lagarde noted that inflation remains stably near the target level, and minor fluctuations "around the mark" are natural and cannot be eliminated. The index will always be slightly above or below 2%, and it's not worth reacting to every such move.

At the same time, Lagarde mentioned that upside risks to inflation persist. Geopolitical shifts, changes in global trade dynamics, and sharp jumps in energy prices could push inflation substantially above the target once again. However, she did not hint at how the ECB might respond in such a scenario or whether the institution is prepared to raise rates again if necessary.

From my perspective, the Eurozone is one of the few global economies that have genuinely returned inflation to its target. For example, the United States and the United Kingdom cannot say the same. The ECB's monetary policy actions in recent years deserve full credit.

If the ECB does not plan to resume monetary easing, I have more bad news for the U.S. dollar. The Federal Reserve will continue to cut interest rates, one way or another. Therefore, the rate spread between the ECB and the Fed, which had been widening for the last year and a half and helped support the dollar, will begin to narrow — an obvious disadvantage for the American currency. It seems that the market is merely accumulating reasons for the next wave of dollar sell-offs. These reasons have already filled the trunk; now it's only a matter of time before the market shifts from building a case to taking action.

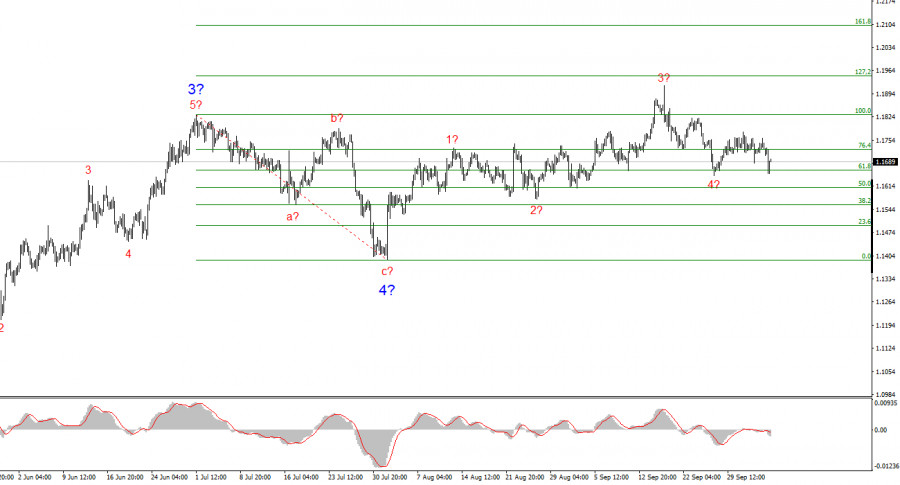

EUR/USD Wave Structure:

Based on my analysis of the EUR/USD pair, it continues to form a bullish wave segment. The wave pattern remains entirely dependent on the news background related to decisions by Trump and the internal and external policies of the new U.S. administration. The target for the current wave can reach up to the 1.2500 level (the 25th figure). At present, a corrective wave 4 appears to be forming, which may already be complete. The overall bullish wave structure remains intact. Therefore, I am currently considering only buy positions. By year-end, I expect the euro to rise toward 1.2245, which corresponds to the 200.0% Fibonacci.

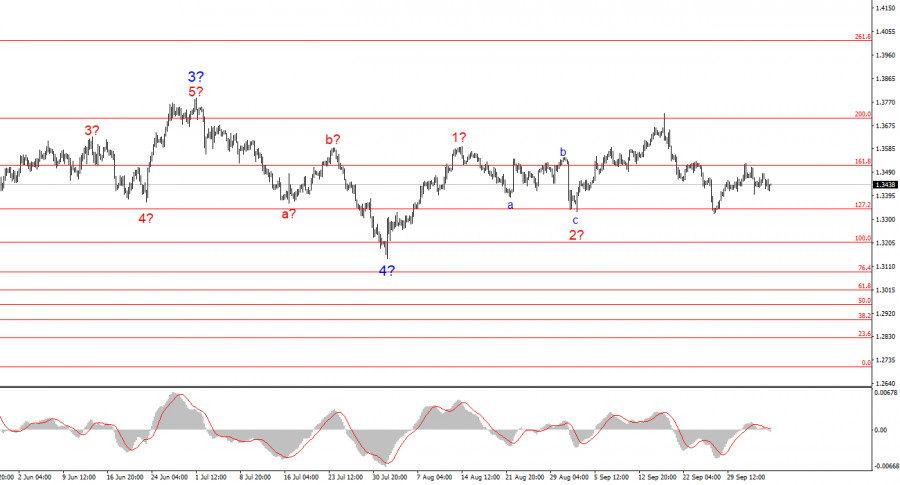

GBP/USD Wave Structure:

The wave structure for GBP/USD has undergone a change. We are still dealing with a bullish impulsive wave; however, its internal structure has become harder to read. If wave 4 develops into a complex three-wave structure, the overall pattern will normalize; however, wave 4 will then be significantly longer and more complicated than wave 2. In my opinion, the most reliable reference point currently is the 1.3341 level, which corresponds to the 127.2% Fibonacci. Two failed breakout attempts at this level have signaled the market's readiness for new buying activity. The pair's targets remain above the 1.3800 level (38th figure).

My Key Analysis Principles:

- Wave structures should be simple and clear. Complex patterns are difficult to trade and often fail to unfold as expected.

- If you're not confident about the market's direction, it's better to stay out.

- There is never 100% certainty in forecasting. Always use stop-loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.