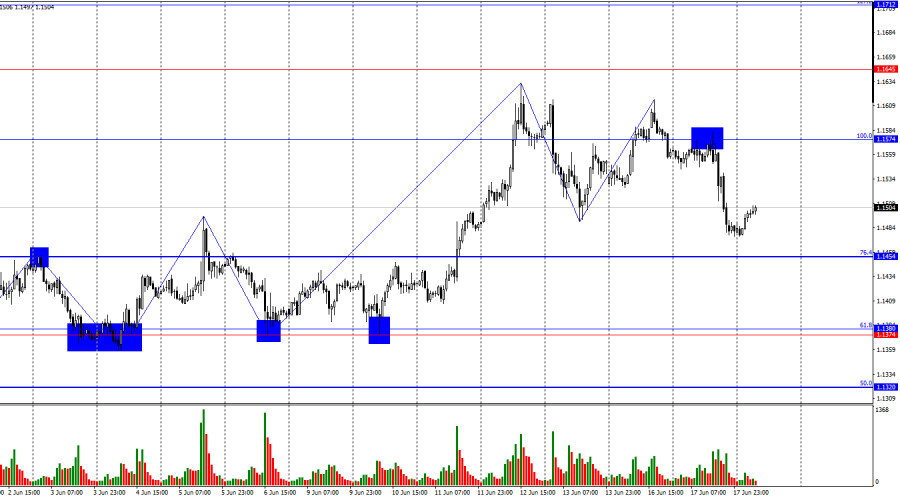

On Tuesday, the EUR/USD pair rebounded from the 100.0% Fibonacci retracement level at 1.1574, reversed in favor of the U.S. dollar, and fell toward the 76.4% Fibonacci level at 1.1454. A rebound from this level today would signal a potential reversal in favor of the euro and a resumption of growth toward 1.1574. A firm move below 1.1454 would suggest a continued decline toward the support zone of 1.1374–1.1380.

The wave situation on the hourly chart remains simple and clear. The last completed upward wave failed to surpass the previous high, while the latest downward wave broke the previous low. This suggests the trend is beginning to shift toward a bearish one. Recent news on higher steel and aluminum tariffs caused bears to retreat again, and the lack of real progress in U.S.–China negotiations keeps them from pressing forward. Thus, I'm not yet confident that the bearish trend will be strong.

Despite a news backdrop that supported bullish traders on Tuesday, the market appears to be trying to confuse traders ahead of major events. U.S. industrial production for May came in below expectations, and retail sales dropped by 0.9% m/m. This gave the bulls a chance to launch another rally.

Instead, it was Donald Trump who took the initiative. The U.S. President called on all civilians to leave Tehran and stated that Iran had enough time to meet the U.S.'s legitimate demands, but now "patience is running out." He added, "We do not want Iran to continue attacking civilians or American soldiers (in Israel). We do not want Iran developing nuclear warheads capable of striking anywhere in the world." Many interpreted these statements as direct signals of imminent U.S. military strikes on Iranian nuclear and military sites. These concerns could have driven the dollar higher due to escalating Middle East tensions.

On the 4-hour chart, the pair has returned to the 127.2% Fibonacci level at 1.1495. A new rebound from this level would suggest a reversal in favor of the euro and renewed growth toward 1.1680. The ascending channel still clearly indicates a bullish trend. A move below 1.1495 would suggest a potential reversal in favor of the U.S. dollar and a decline toward the lower boundary of the channel. No emerging divergences are currently observed.

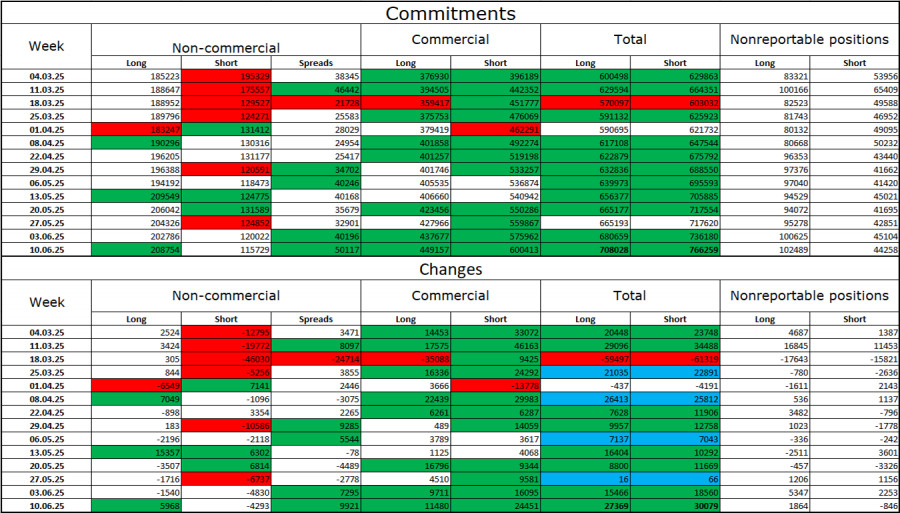

Commitments of Traders (COT) Report

Over the last reporting week, professional traders opened 5,968 new long positions and closed 4,293 short ones. The sentiment of the "Non-commercial" group remains bullish, largely influenced by Donald Trump. The total number of long positions held by speculators is now 208,000, compared to 115,000 short positions. The gap between long and short positions continues to widen (with few exceptions), showing ongoing demand for the euro and weak interest in the dollar.

For 19 consecutive weeks, large players have been cutting short positions and increasing longs. The difference in monetary policy (MP) between the ECB and the Fed is already significant, but Trump's policies carry even more weight for traders, as they could trigger a U.S. recession and other long-term structural issues.

News Calendar – U.S. and Eurozone:

- Eurozone – Consumer Price Index (09:00 UTC)

- U.S. – Building Permits (12:30 UTC)

- U.S. – Housing Starts (12:30 UTC)

- U.S. – FOMC Rate Decision (18:00 UTC)

- U.S. – Dot Plot (18:00 UTC)

- U.S. – Jerome Powell's Press Conference (18:30 UTC)

On June 18, the calendar includes several important and some secondary entries. Thus, the information background may have moderate influence during the day and strong influence in the evening.

EUR/USD Forecast and Trading Tips:

Short positions could have been opened after the pair closed below 1.1574 on the hourly chart, targeting 1.1454. These trades can now be closed. New short entries are possible on a rebound from 1.1574 or a firm break below 1.1454. I would recommend buying on a rebound from 1.1454 with a target at 1.1574, or on a close above 1.1574 with a target at 1.1645.

Fibonacci levels are drawn from 1.1574 to 1.1066 on the hourly chart and from 1.1214 to 1.0179 on the 4-hour chart.